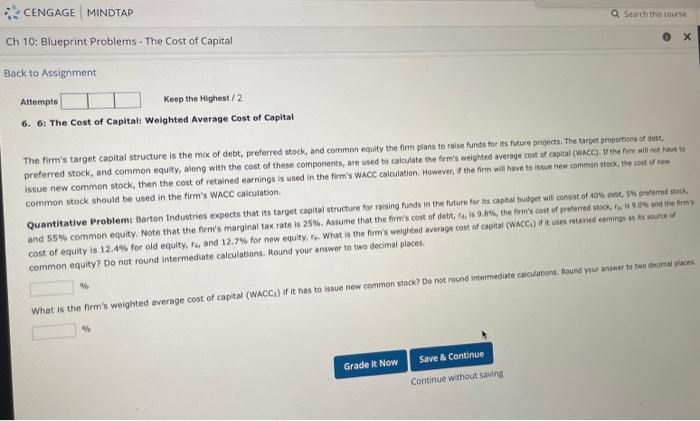

Question: a Starch the course CENGAGE MINDTAP Ch 10: Blueprint Problems - The Cost of Capital Back to Assignment Attempts Keep the Highest / 2 6.

a Starch the course CENGAGE MINDTAP Ch 10: Blueprint Problems - The Cost of Capital Back to Assignment Attempts Keep the Highest / 2 6. 6: The Cost of Capital: Weighted Average cost of Capital The firm's target capital structure is the mix of debt, preferred stock, and common equity the firm plans to raise funds for its future projects. The target proportion of det preferred stock, and common equity, along with the cost of these components, are used to calculate the firm's weighted average cost of capital (WACC). Ir the fem will not have to issue new common stock, then the cost of retained earnings is used in the firm's WACC calculation. However, if the firm will have to le new common stock, the cost of rew common stock should be used in the firm's WACC calculation, Quantitative Problemi Barton Industries expects that its target capital structure for raising funds in the future for its captar budget will consist of 40,5 preferred stock, and 55% common equity. Note that the firm's marginal tax rate is 25. Assume that the firm's cost of debt, 9.84, the firm's cost of preferred stock, 9.0% and cost of equity is 12.4% for old equity, and 12.7% for new equity, re. Wit is the firm's weighted average cost of capital (WACC) it uses retained canings as source of common equity? Do not round Intermediate calculations. Round your answer to two decimal places What is the firm's weighted average cost of capita (WACC) if it has to issue new common stock? Do not round intermediate calculation. Round your answer to two deomal plan Save & Continue Grade it Now Continue without saving

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts