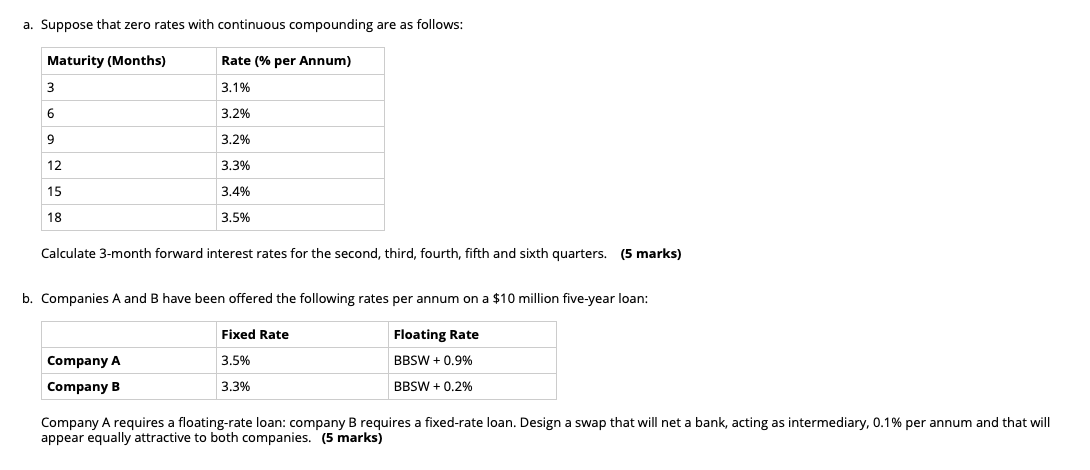

Question: a. Suppose that zero rates with continuous compounding are as follows: Maturity (Months) 3 6 9 12 15 18 Rate (% per Annum) 3.1% 3.2%

a. Suppose that zero rates with continuous compounding are as follows: Maturity (Months) 3 6 9 12 15 18 Rate (% per Annum) 3.1% 3.2% 3.2% 3.3% 3.4% 3.5% Calculate 3-month forward interest rates for the second, third, fourth, fifth and sixth quarters. (5 marks) b. Companies A and B have been offered the following rates per annum on a $10 million five-year loan: Floating Rate BBSW + 0.9% BBSW + 0.2% Company A Company B Fixed Rate 3.5% 3.3% Company A requires a floating-rate loan: company B requires a fixed-rate loan. Design a swap that will net a bank, acting as intermediary, 0.1% per annum and that will appear equally attractive to both companies. (5 marks) a. Suppose that zero rates with continuous compounding are as follows: Maturity (Months) 3 6 9 12 15 18 Rate (% per Annum) 3.1% 3.2% 3.2% 3.3% 3.4% 3.5% Calculate 3-month forward interest rates for the second, third, fourth, fifth and sixth quarters. (5 marks) b. Companies A and B have been offered the following rates per annum on a $10 million five-year loan: Floating Rate BBSW + 0.9% BBSW + 0.2% Company A Company B Fixed Rate 3.5% 3.3% Company A requires a floating-rate loan: company B requires a fixed-rate loan. Design a swap that will net a bank, acting as intermediary, 0.1% per annum and that will appear equally attractive to both companies

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts