Question: A. TRUE / FALSE QUESTIONS Enter True or False on the blank preceding each question. 1. An annuity is a series of equal, periodic payments

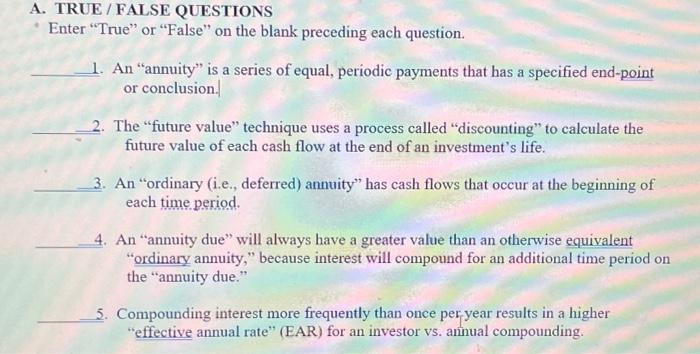

A. TRUE / FALSE QUESTIONS Enter "True" or "False" on the blank preceding each question. 1. An "annuity" is a series of equal, periodic payments that has a specified end-point or conclusion. 2. The "future value" technique uses a process called "discounting" to calculate the future value of each cash flow at the end of an investment's life. 3. An "ordinary (i.e., deferred) annuity" has cash flows that occur at the beginning of each time period. 4. An "annuity due" will always have a greater value than an otherwise equivalent "ordinary annuity," because interest will compound for an additional time period on the "annuity due." 5. Compounding interest more frequently than once per year results in a higher "effective annual rate" (EAR) for an investor vs. annual compounding

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts