Question: A. TRUE / FALSE QUESTIONS Enter True or False on the blank preceding each question. 1. A time line can be drawn to illustrate the

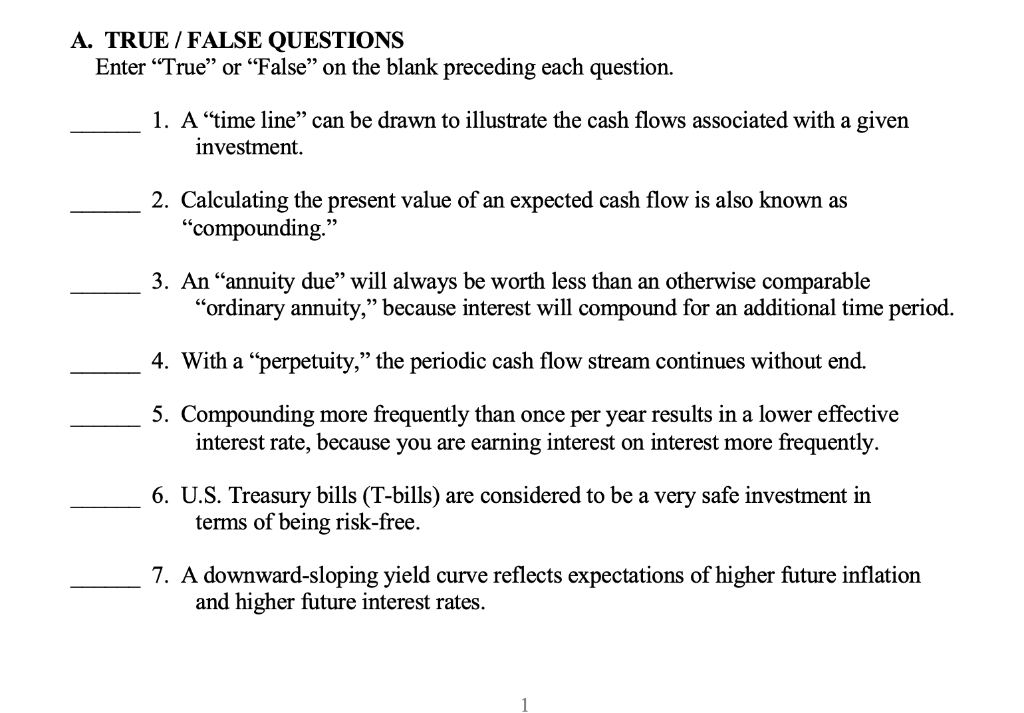

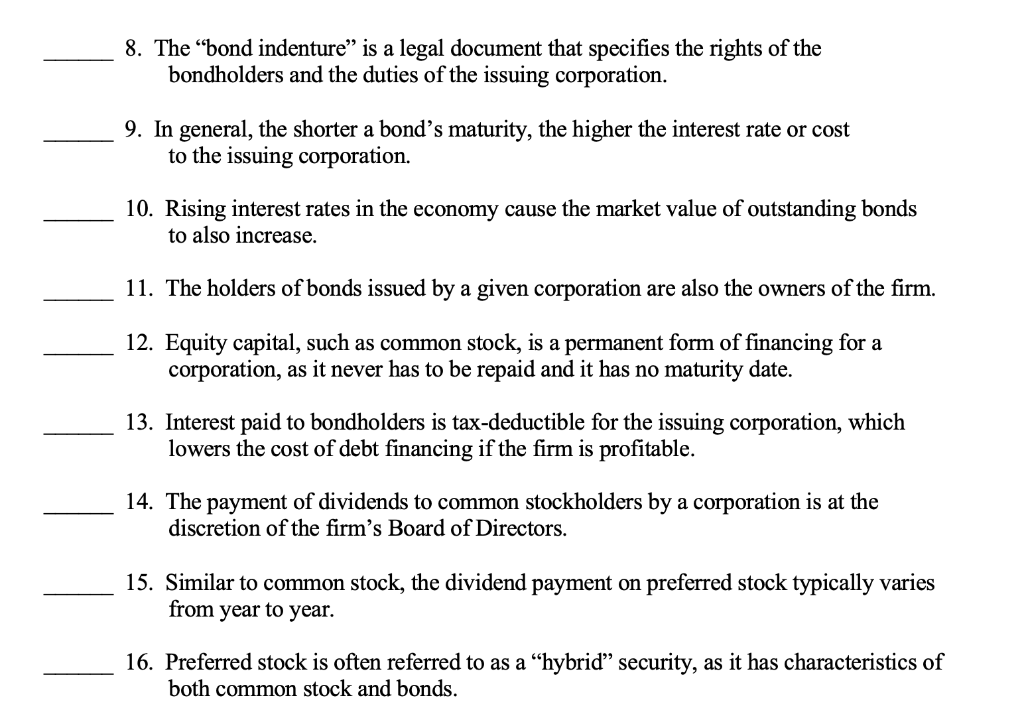

A. TRUE / FALSE QUESTIONS Enter "True" or "False" on the blank preceding each question. 1. A "time line" can be drawn to illustrate the cash flows associated with a given investment. 2. Calculating the present value of an expected cash flow is also known as "compounding." 3. An "annuity due" will always be worth less than an otherwise comparable "ordinary annuity," because interest will compound for an additional time period. 4. With a "perpetuity," the periodic cash flow stream continues without end. 5. Compounding more frequently than once per year results in a lower effective interest rate, because you are earning interest on interest more frequently. 6. U.S. Treasury bills (T-bills) are considered to be a very safe investment in terms of being risk-free. 7. A downward-sloping yield curve reflects expectations of higher future inflation and higher future interest rates. 8. The "bond indenture" is a legal document that specifies the rights of the bondholders and the duties of the issuing corporation. 9. In general, the shorter a bond's maturity, the higher the interest rate or cost to the issuing corporation. 10. Rising interest rates in the economy cause the market value of outstanding bonds to also increase. 11. The holders of bonds issued by a given corporation are also the owners of the firm. 12. Equity capital, such as common stock, is a permanent form of financing for a corporation, as it never has to be repaid and it has no maturity date. 13. Interest paid to bondholders is tax-deductible for the issuing corporation, which lowers the cost of debt financing if the firm is profitable. 14. The payment of dividends to common stockholders by a corporation is at the discretion of the firm's Board of Directors. 15. Similar to common stock, the dividend payment on preferred stock typically varies from year to year. 16. Preferred stock is often referred to as a "hybrid" security, as it has characteristics of both common stock and bonds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts