Question: A. TRUE / FALSE QUESTIONS Enter True or False on the blank preceding each question. 1. The purchase of additional physical facilities, such as additional

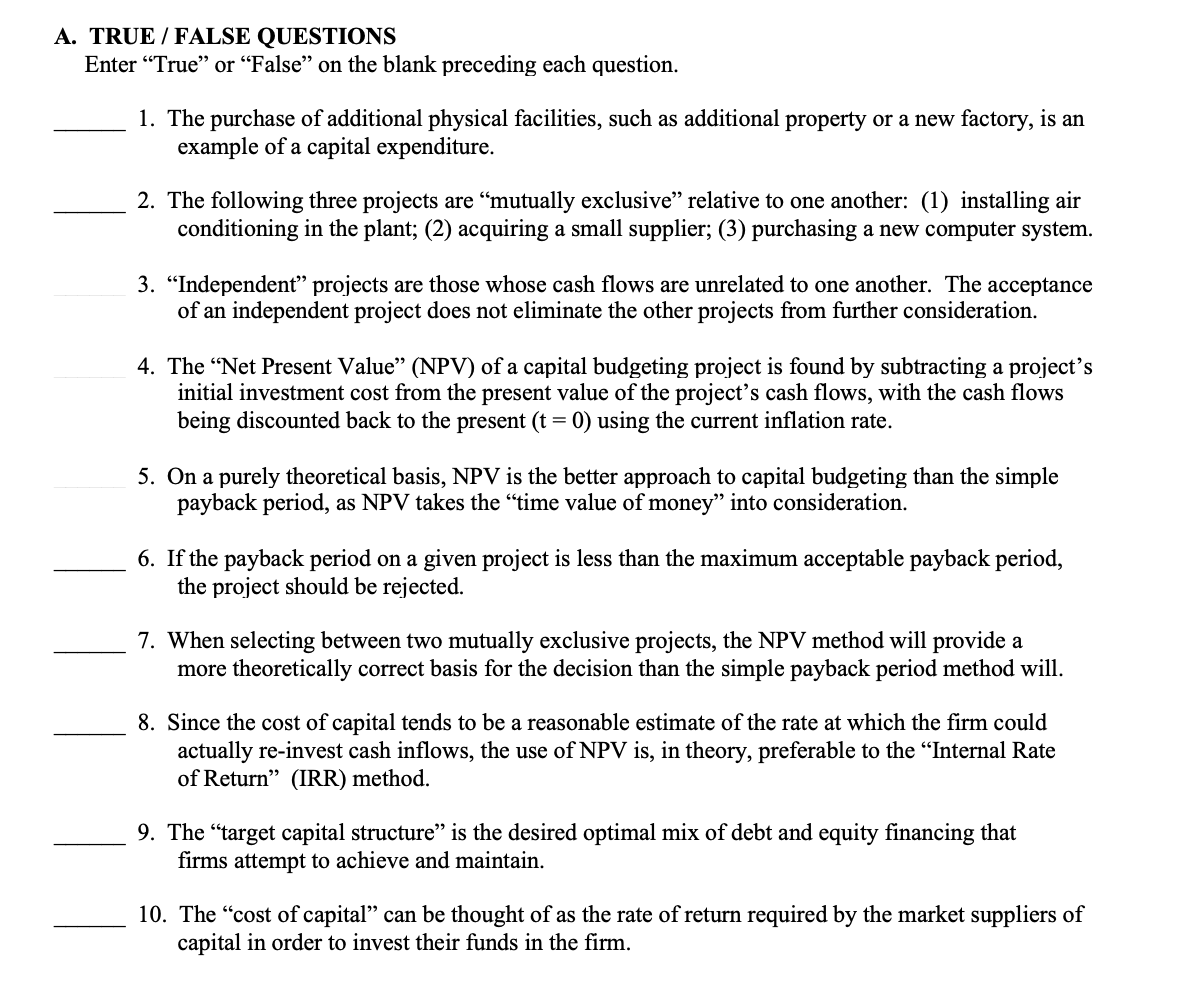

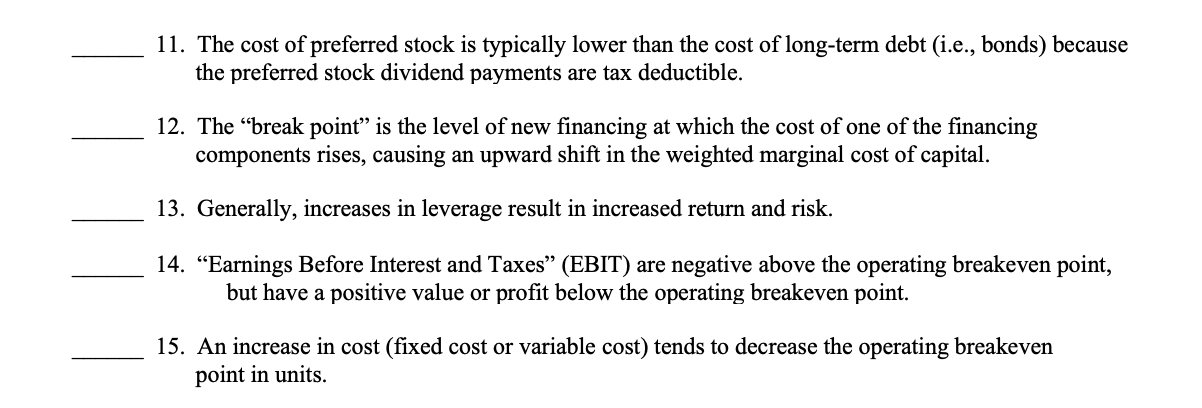

A. TRUE / FALSE QUESTIONS Enter "True" or "False" on the blank preceding each question. 1. The purchase of additional physical facilities, such as additional property or a new factory, is an example of a capital expenditure. 2. The following three projects are "mutually exclusive" relative to one another: (1) installing air conditioning in the plant; (2) acquiring a small supplier; (3) purchasing a new computer system. 3. "Independent" projects are those whose cash flows are unrelated to one another. The acceptance of an independent project does not eliminate the other projects from further consideration. 4. The "Net Present Value" (NPV) of a capital budgeting project is found by subtracting a project's initial investment cost from the present value of the project's cash flows, with the cash flows being discounted back to the present (t=0) using the current inflation rate. 5. On a purely theoretical basis, NPV is the better approach to capital budgeting than the simple payback period, as NPV takes the "time value of money" into consideration. 6. If the payback period on a given project is less than the maximum acceptable payback period, the project should be rejected. 7. When selecting between two mutually exclusive projects, the NPV method will provide a more theoretically correct basis for the decision than the simple payback period method will. 8. Since the cost of capital tends to be a reasonable estimate of the rate at which the firm could actually re-invest cash inflows, the use of NPV is, in theory, preferable to the "Internal Rate of Return" (IRR) method. 9. The "target capital structure" is the desired optimal mix of debt and equity financing that firms attempt to achieve and maintain. 10. The "cost of capital" can be thought of as the rate of return required by the market suppliers of capital in order to invest their funds in the firm. 11. The cost of preferred stock is typically lower than the cost of long-term debt (i.e., bonds) because the preferred stock dividend payments are tax deductible. 12. The "break point" is the level of new financing at which the cost of one of the financing components rises, causing an upward shift in the weighted marginal cost of capital. 13. Generally, increases in leverage result in increased return and risk. 14. "Earnings Before Interest and Taxes" (EBIT) are negative above the operating breakeven point, but have a positive value or profit below the operating breakeven point. 15. An increase in cost (fixed cost or variable cost) tends to decrease the operating breakeven point in units

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts