Question: A | U e | 4 2 | 0 2 | S E | S A | 9 L | S A | 9 L

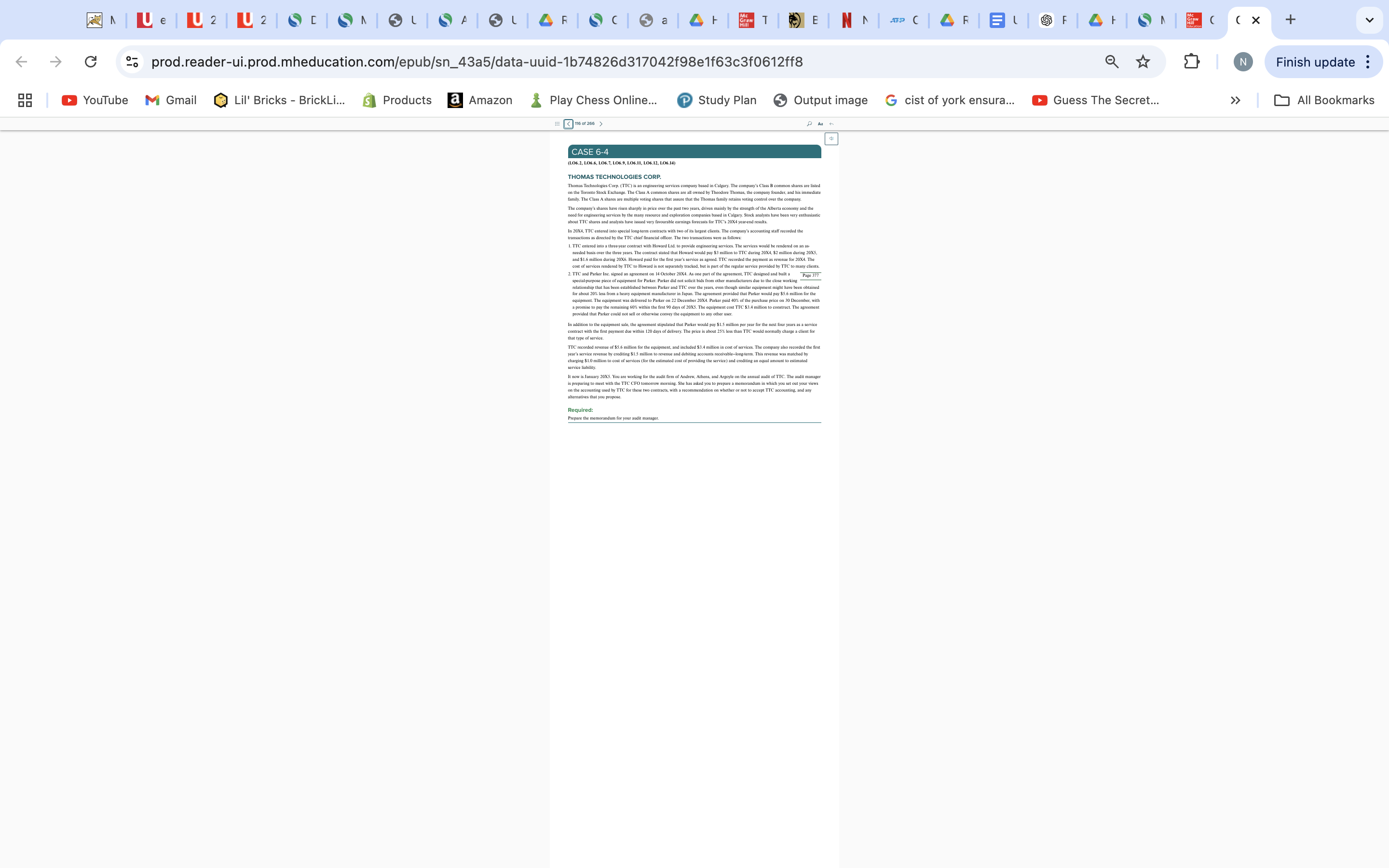

A | U e | 4 2 | 0 2 | S E | S A | 9 L | S A | 9 L | A F | S C | 3 2 | A t TE| NAPCAREISFA SNSC (X G go prod.reader-ui.prod.mheducation.com/epub/sn_43a5/data-uuid-1674826d317042f98elf63c3f0612ff8 N Finish update : YouTube M Gmail Lil' Bricks - BrickLi... s Products a Amazon Play Chess Online... Study Plan Output image G cist of york ensura... Guess The Secret... > > All Bookmarks CASE 6-4 106.2, LO6.6, LO6.7, LO6.9, LO6.11, LO6.12, LO6.14) THOMAS TECHNOLOGIES CORP. Thomas Technologies Corp. (TIC) is an engineering services company based in Calgary. The company's Class B common shares are listed family. The Class A shares are multiple voting shares romas, the company founder, and his immediate that the Thomas family retains voting control owes us who this time The company's shares have risen sharply in price over the past two years, driven mainly by the strength of the Alberta economy toration companies based in Calgary. Stock analysts have been very enthusiastic alous TTC shares and analysts have issued very favourable earnings forecasts for TTC'S joyalways have asks for TTC's 20X4 year en 20X4. TTC entered into on 1 20X4. TIC entered into special long-term contracts with two of its largest clients. The company's accounting staff recorded the transactions as directed by the TTC chief financial officer. The two transactions were as follows: 1. TTC entered into a three year contract with Howard Lid. to provide engineering services. The services would be rendered on an as- needed basis over the three years. The contract stated that Howard would pay $3 million to TTC during 20X4, $2 million during 20x5 needed basis over the three years. The contract stated that howard would pay 53 minon to Ire during 2084, $2 million during 20X5. and $1.6 million during 20X6. Howard paid for the first year's service as agreed. TTC recorded the payment as revenue for 20X4. The cost of services rendered by TTC to Howard is not separately tracked but is part of the regular service provided by TTC to many clients cost of services rendered by I've to froward is not separately tracked, but is part of the regular service provided by TTC to many client . TTC and Parker Inc. signed an agreement on 14 October 20X4. As one part of the agreement, TTC designed and built a special purpose piece of equipment for Parker. Parker did not solicit bids from other manufacturers due to the close working relationship that has been established between Parker and TTC over the years, even though similar equipment might have been obtained equipment. The equipment was delivered to Parker on 22 December 20X4. Parker paid 40% of the purchase price on 30 December, with a promise to pay the remaining 60% within the first 90 days of 20X5. The come promise to pay the remaining 60% within the first 90 days of 20X5. The equipment cost TTC $3.4 million to construct. The agreement provided that Parker could not sell or otherwise convey the equipment to any other user. tion to the equipment sale, the agreement stipulated that Parker w the cement stipulated that Parker would pay $1.5 million per year for the next four years as a service contract with the first payment due within 120 days of delivery. The price is about 25% less than TTC would normally charge a client for that type of service. ITC recorded revenue of $5.6 million for the equipment, and included $5.4 million in cost of services. The company also recorded the first charging $1.0 million to cost of services (for the estimated cost of providing the service) and crediting an equal amount to estimated service liability. It now is January 20XS. You are working for the audit firm of Andrew. Athens, and Argoyle on the annual audit of TTC. The audit manager on the accounting used by TTC for these two contracts, with a recommendation on whether or not to accept TTC accounting, and any alternatives that you propose. Required: Prepare the memorandum for your audit manager

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts