Question: A UK based client holds a well-diversified equity portfolio which has finally regained all the value it lost during the recent COVID-19 related crash. The

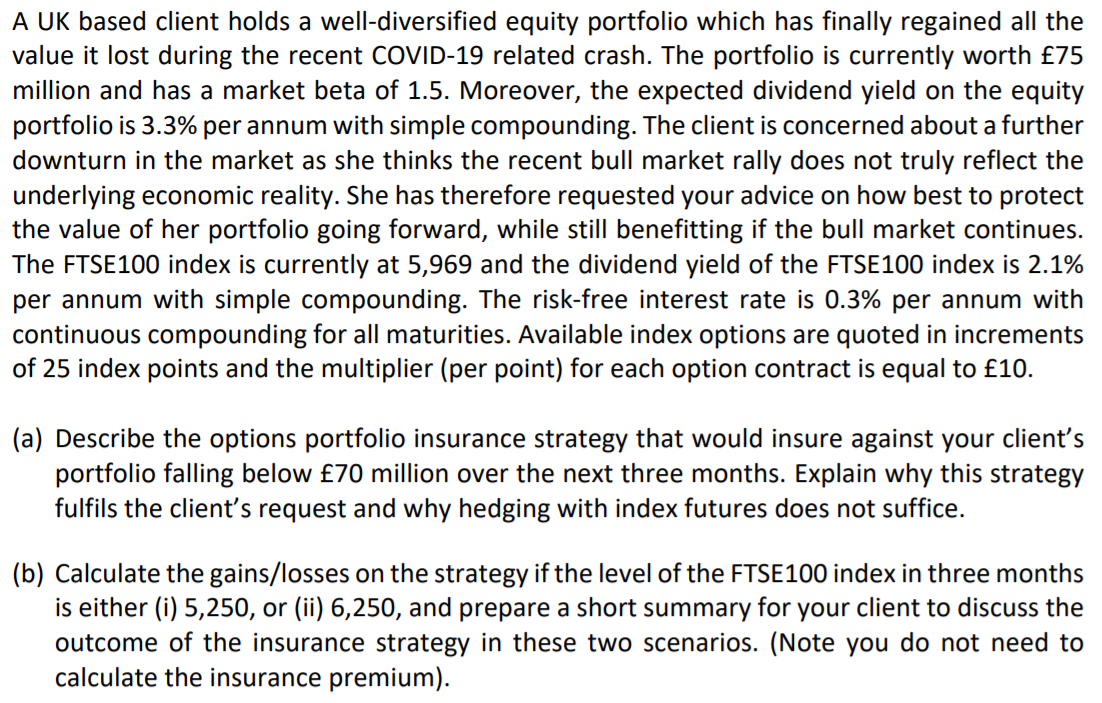

A UK based client holds a well-diversified equity portfolio which has finally regained all the value it lost during the recent COVID-19 related crash. The portfolio is currently worth 75 million and has a market beta of 1.5. Moreover, the expected dividend yield on the equity portfolio is 3.3% per annum with simple compounding. The client is concerned about a further downturn in the market as she thinks the recent bull market rally does not truly reflect the underlying economic reality. She has therefore requested your advice on how best to protect the value of her portfolio going forward, while still benefitting if the bull market continues. The FTSE100 index is currently at 5,969 and the dividend yield of the FTSE100 index is 2.1% per annum with simple compounding. The risk-free interest rate is 0.3% per annum with continuous compounding for all maturities. Available index options are quoted in increments of 25 index points and the multiplier (per point) for each option contract is equal to 10. (a) Describe the options portfolio insurance strategy that would insure against your client's portfolio falling below 70 million over the next three months. Explain why this strategy fulfils the client's request and why hedging with index futures does not suffice. (b) Calculate the gains/losses on the strategy if the level of the FTSE100 index in three months is either (i) 5,250, or (ii) 6,250, and prepare a short summary for your client to discuss the outcome of the insurance strategy in these two scenarios. (Note you do not need to calculate the insurance premium). A UK based client holds a well-diversified equity portfolio which has finally regained all the value it lost during the recent COVID-19 related crash. The portfolio is currently worth 75 million and has a market beta of 1.5. Moreover, the expected dividend yield on the equity portfolio is 3.3% per annum with simple compounding. The client is concerned about a further downturn in the market as she thinks the recent bull market rally does not truly reflect the underlying economic reality. She has therefore requested your advice on how best to protect the value of her portfolio going forward, while still benefitting if the bull market continues. The FTSE100 index is currently at 5,969 and the dividend yield of the FTSE100 index is 2.1% per annum with simple compounding. The risk-free interest rate is 0.3% per annum with continuous compounding for all maturities. Available index options are quoted in increments of 25 index points and the multiplier (per point) for each option contract is equal to 10. (a) Describe the options portfolio insurance strategy that would insure against your client's portfolio falling below 70 million over the next three months. Explain why this strategy fulfils the client's request and why hedging with index futures does not suffice. (b) Calculate the gains/losses on the strategy if the level of the FTSE100 index in three months is either (i) 5,250, or (ii) 6,250, and prepare a short summary for your client to discuss the outcome of the insurance strategy in these two scenarios. (Note you do not need to calculate the insurance premium)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts