Question: a) Using a Binomial pricing model with 1-month steps, find the price of a 3-month American Call and a 3- month American Put option with

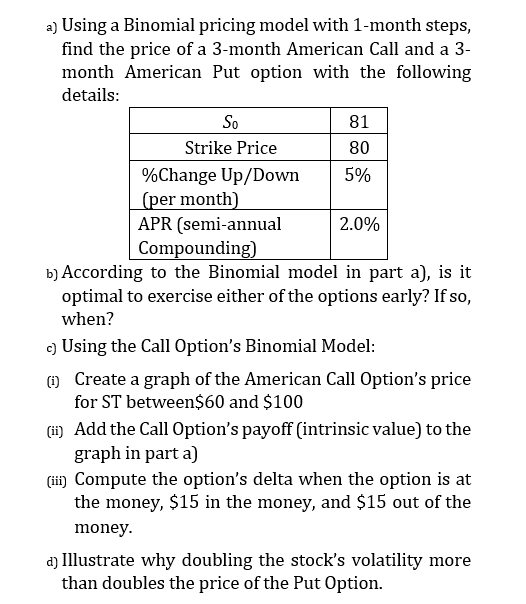

a) Using a Binomial pricing model with 1-month steps, find the price of a 3-month American Call and a 3- month American Put option with the following details: So 81 Strike Price 80 %Change Up/Down 5% (per month) APR (semi-annual 2.0% Compounding) b) According to the Binomial model in part a), is it optimal to exercise either of the options early? If so, when? c) Using the Call Option's Binomial Model: (1) Create a graph of the American Call Option's price for ST between$60 and $100 (ii) Add the Call Option's payoff intrinsic value) to the graph in part a) (iii) Compute the option's delta when the option is at the money, $15 in the money, and $15 out of the money. d) Illustrate why doubling the stock's volatility more than doubles the price of the Put Option. a) Using a Binomial pricing model with 1-month steps, find the price of a 3-month American Call and a 3- month American Put option with the following details: So 81 Strike Price 80 %Change Up/Down 5% (per month) APR (semi-annual 2.0% Compounding) b) According to the Binomial model in part a), is it optimal to exercise either of the options early? If so, when? c) Using the Call Option's Binomial Model: (1) Create a graph of the American Call Option's price for ST between$60 and $100 (ii) Add the Call Option's payoff intrinsic value) to the graph in part a) (iii) Compute the option's delta when the option is at the money, $15 in the money, and $15 out of the money. d) Illustrate why doubling the stock's volatility more than doubles the price of the Put Option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts