Question: a) Using a Binomial pricing model with 1-month steps, find the price of a 3-month American Call and a 3-month American Put option with the

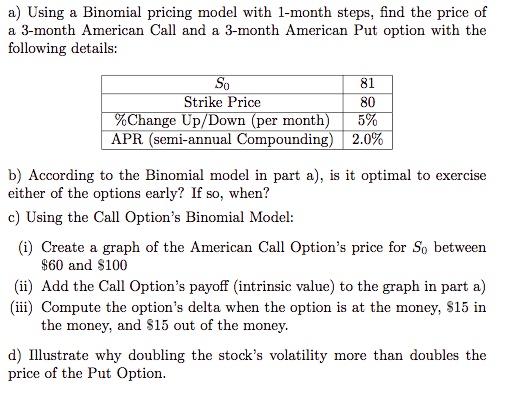

a) Using a Binomial pricing model with 1-month steps, find the price of a 3-month American Call and a 3-month American Put option with the following details: So 81 Strike Price 80 %Change Up/Down (per month) 5% APR (semi-annual Compounding) 2.0% b) According to the Binomial model in part a), is it optimal to exercise either of the options early? If so, when? c) Using the Call Option's Binomial Model: (i) Create a graph of the American Call Option's price for So between $60 and $100 (ii) Add the Call Option's payoff (intrinsic value) to the graph in part a) (iii) Compute the option's delta when the option is at the money, S15 in the money, and $15 out of the money. d) Illustrate why doubling the stock's volatility more than doubles the price of the Put Option. a) Using a Binomial pricing model with 1-month steps, find the price of a 3-month American Call and a 3-month American Put option with the following details: So 81 Strike Price 80 %Change Up/Down (per month) 5% APR (semi-annual Compounding) 2.0% b) According to the Binomial model in part a), is it optimal to exercise either of the options early? If so, when? c) Using the Call Option's Binomial Model: (i) Create a graph of the American Call Option's price for So between $60 and $100 (ii) Add the Call Option's payoff (intrinsic value) to the graph in part a) (iii) Compute the option's delta when the option is at the money, S15 in the money, and $15 out of the money. d) Illustrate why doubling the stock's volatility more than doubles the price of the Put Option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts