Question: A. Using Ms Excel, find out which alternative should be selected on the basis of the Present Worth method, if the rate of interest is

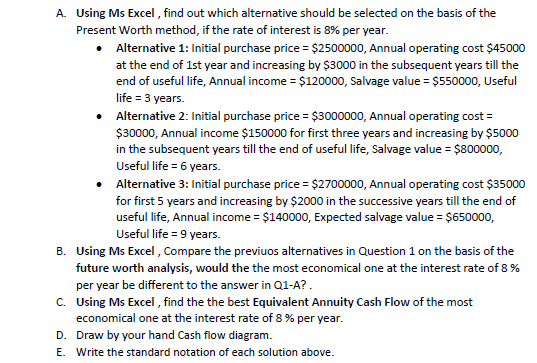

A. Using Ms Excel, find out which alternative should be selected on the basis of the Present Worth method, if the rate of interest is 8% per year. Alternative 1: Initial purchase price = $2500000, Annual operating cost $45000 at the end of 1st year and increasing by $3000 in the subsequent years till the end of useful life, Annual income = $120000, Salvage value = $550000, Useful life = 3 years. Alternative 2: Initial purchase price = $3000000, Annual operating cost = $30000, Annual income $150000 for first three years and increasing by $5000 in the subsequent years till the end of useful life, Salvage value = $800000, Useful life = 6 years. Alternative 3: Initial purchase price = $2700000, Annual operating cost $35000 for first 5 years and increasing by $2000 in the successive years till the end of useful life, Annual income = $140000, Expected salvage value = $650000, Useful life = 9 years. B. Using Ms Excel, Compare the previuos alternatives in Question 1 on the t future worth analysis, would the the most economical one at the interest rate of 8 % per year be different to the answer in Q1-A?. C. Using Ms Excel , find the the best Equivalent Annuity Cash Flow of the most economical one at the interest rate of 8 % per year. D. Draw by your hand cash flow diagram. E. Write the standard notation of each solution above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts