Question: a. Using the information from Table 1, calculate the expected return, standard deviation of returns and covariance of returns with the market (Mkt) returns of

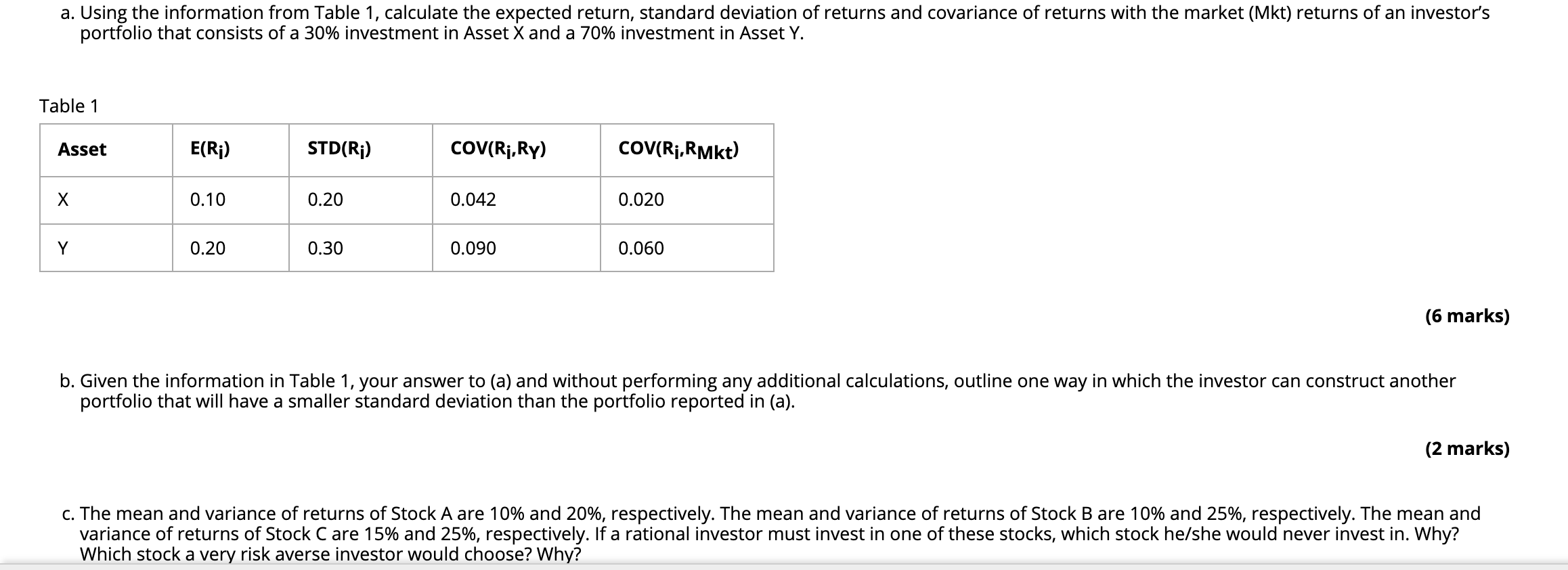

a. Using the information from Table 1, calculate the expected return, standard deviation of returns and covariance of returns with the market (Mkt) returns of an investor's portfolio that consists of a 30% investment in Asset X and a 70% investment in Asset Y. Table 1 Asset E(Ri) STD(Ri) COV(Ri, Ry) COV(Ri,RMkt) X 0.10 0.20 0.042 0.020 Y 0.20 0.30 0.090 0.060 (6 marks) b. Given the information in Table 1, your answer to (a) and without performing any additional calculations, outline one way in which the investor can construct another portfolio that will have a smaller standard deviation than the portfolio reported in (a). (2 marks) c. The mean and variance of returns of Stock A are 10% and 20%, respectively. The mean and variance of returns of Stock B are 10% and 25%, respectively. The mean and variance of returns of Stock C are 15% and 25%, respectively. If a rational investor must invest in one of these stocks, which stock he/she would never invest in. Why? Which stock a very risk averse investor would choose? Why? a. Using the information from Table 1, calculate the expected return, standard deviation of returns and covariance of returns with the market (Mkt) returns of an investor's portfolio that consists of a 30% investment in Asset X and a 70% investment in Asset Y. Table 1 Asset E(Ri) STD(Ri) COV(Ri, Ry) COV(Ri,RMkt) X 0.10 0.20 0.042 0.020 Y 0.20 0.30 0.090 0.060 (6 marks) b. Given the information in Table 1, your answer to (a) and without performing any additional calculations, outline one way in which the investor can construct another portfolio that will have a smaller standard deviation than the portfolio reported in (a). (2 marks) c. The mean and variance of returns of Stock A are 10% and 20%, respectively. The mean and variance of returns of Stock B are 10% and 25%, respectively. The mean and variance of returns of Stock C are 15% and 25%, respectively. If a rational investor must invest in one of these stocks, which stock he/she would never invest in. Why? Which stock a very risk averse investor would choose? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts