Question: A. What are the basic assumptions behind the Markowitz portfolio theory? (10 Marks B. What happens to the portfolio standard deviation when the correlation between

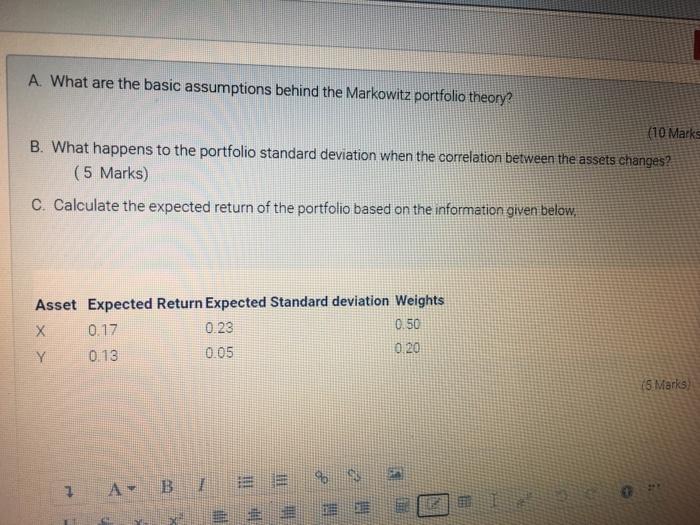

A. What are the basic assumptions behind the Markowitz portfolio theory? (10 Marks B. What happens to the portfolio standard deviation when the correlation between the assets changes? (5 Marks) C. Calculate the expected return of the portfolio based on the information given below, Asset Expected Return Expected Standard deviation Weights 0.17 0.23 0.50 Y 0.13 0.05 0.20 15 Marks 112 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts