Question: a. What are the incremental earnings for this project for years 1 and 2? b. What are the free cash flows for this project for

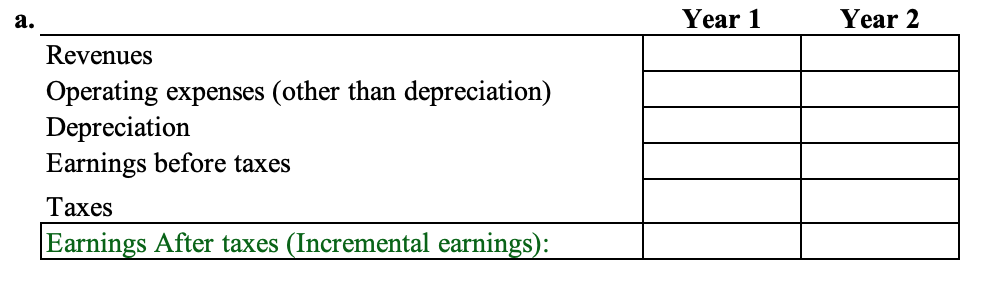

a. What are the incremental earnings for this project for years 1 and 2?

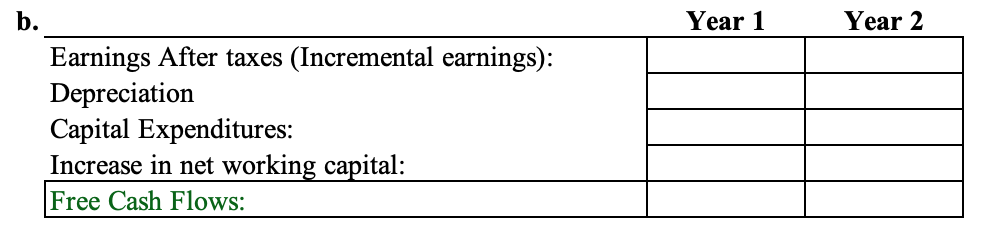

b. What are the free cash flows for this project for the first two years?

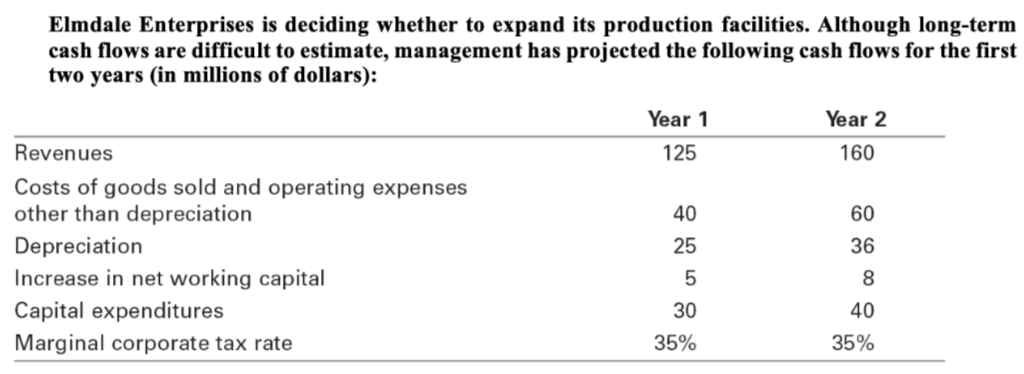

Elmdale Enterprises is deciding whether to expand its production facilities. Although long-term cash flows are difficult to estimate, management has projected the following cash flows for the first two years (in millions of dollars): Year 1 Year 2 160 Revenues Costs of goods sold and operating expenses other than depreciation Depreciation Increase in net working capital Capital expenditures Marginal corporate tax rate 125 40 25 5 30 60 36 8 40 35% 35% a. Year 1 Year 2 Revenue:s Operating expenses (other than depreciation) Depreciation Earnings before taxes Taxes Earnings After taxes (Incremental earnings): b. Year 1 Year 2 Earnings After taxes (Incremental earnings) Depreciation Capital Expenditures: Increase in net working capital: Free Cash Flows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts