Question: The engineering company entered into a contract with Menara Engineering Pte Ltd (Menara), a non-resident company, for the provision of offshore design services and the

The engineering company entered into a contract with Menara Engineering Pte Ltd (Menara), a non-resident company, for the provision of offshore design services and the placement of Menara's secondment of technical officer on 21 February 2020. Two employees of Menara will be seconded and placed under the employment of the company at offshore for a period of two years. Their salaries will be borne by the company. On 30 August 2020 paid RM90,000 to Menara for consultancy service rendered in Malaysia. Required:

(i) State, with reasons, whether withholding tax is applicable to all payments made to Menara. (2 marks)

(ii) State, with reasons, whether Menara is considered to have a permanent establishment in Malaysia for the secondment of the company’s two staff at the company. (2 marks)

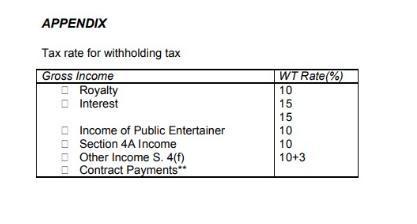

APPENDIX Tax rate for withholding tax Gross Income Royalty Interest Income of Public Entertainer Section 4A Income Other Income S. 4(f) Contract Payments** WT Rate(%) 10 15 15 10 10 10+3

Step by Step Solution

3.38 Rating (154 Votes )

There are 3 Steps involved in it

i Withholding tax is not applicable to all payments made to Menara b... View full answer

Get step-by-step solutions from verified subject matter experts