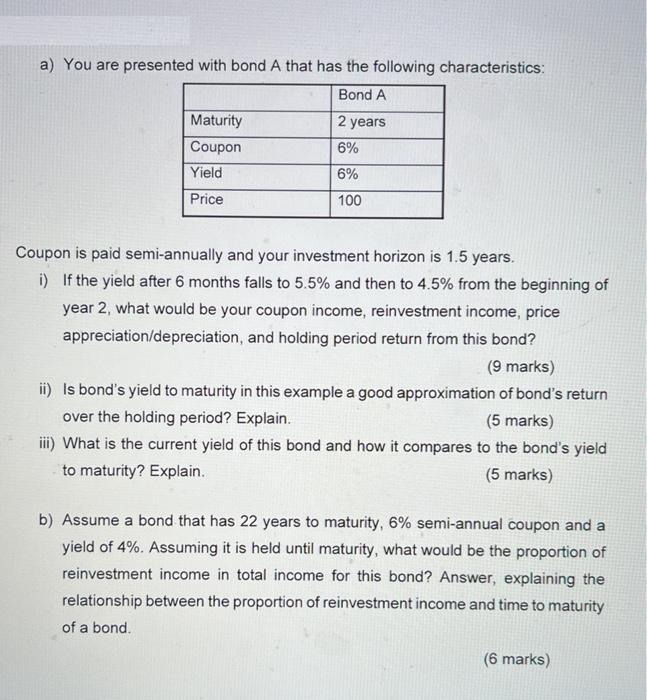

Question: a) You are presented with bond A that has the following characteristics: Bond A Maturity Coupon Yield Price 2 years 6% 6% 100 Coupon

a) You are presented with bond A that has the following characteristics: Bond A Maturity Coupon Yield Price 2 years 6% 6% 100 Coupon is paid semi-annually and your investment horizon is 1.5 years. i) If the yield after 6 months falls to 5.5% and then to 4.5% from the beginning of year 2, what would be your coupon income, reinvestment income, price appreciation/depreciation, and holding period return from this bond? (9 marks) ii) Is bond's yield to maturity in this example a good approximation of bond's return over the holding period? Explain. (5 marks) iii) What is the current yield of this bond and how it compares to the bond's yield to maturity? Explain. (5 marks) b) Assume a bond that has 22 years to maturity, 6% semi-annual coupon and a yield of 4%. Assuming it is held until maturity, what would be the proportion of reinvestment income in total income for this bond? Answer, explaining the relationship between the proportion of reinvestment income and time to maturity of a bond. (6 marks)

Step by Step Solution

3.50 Rating (150 Votes )

There are 3 Steps involved in it

a Question 1 Coupon Income 62 x 100 6 Reinvestment Income 552 x 100 550 Price AppreciationDepreciation 100 100 0 Holding Period Return 6 550 100 115 The coupon income for Bond A is calculated by takin... View full answer

Get step-by-step solutions from verified subject matter experts