Question: . A1 X V fx WACC A B D E F G H I j K L M N o 1 WACC 2 3 Equity

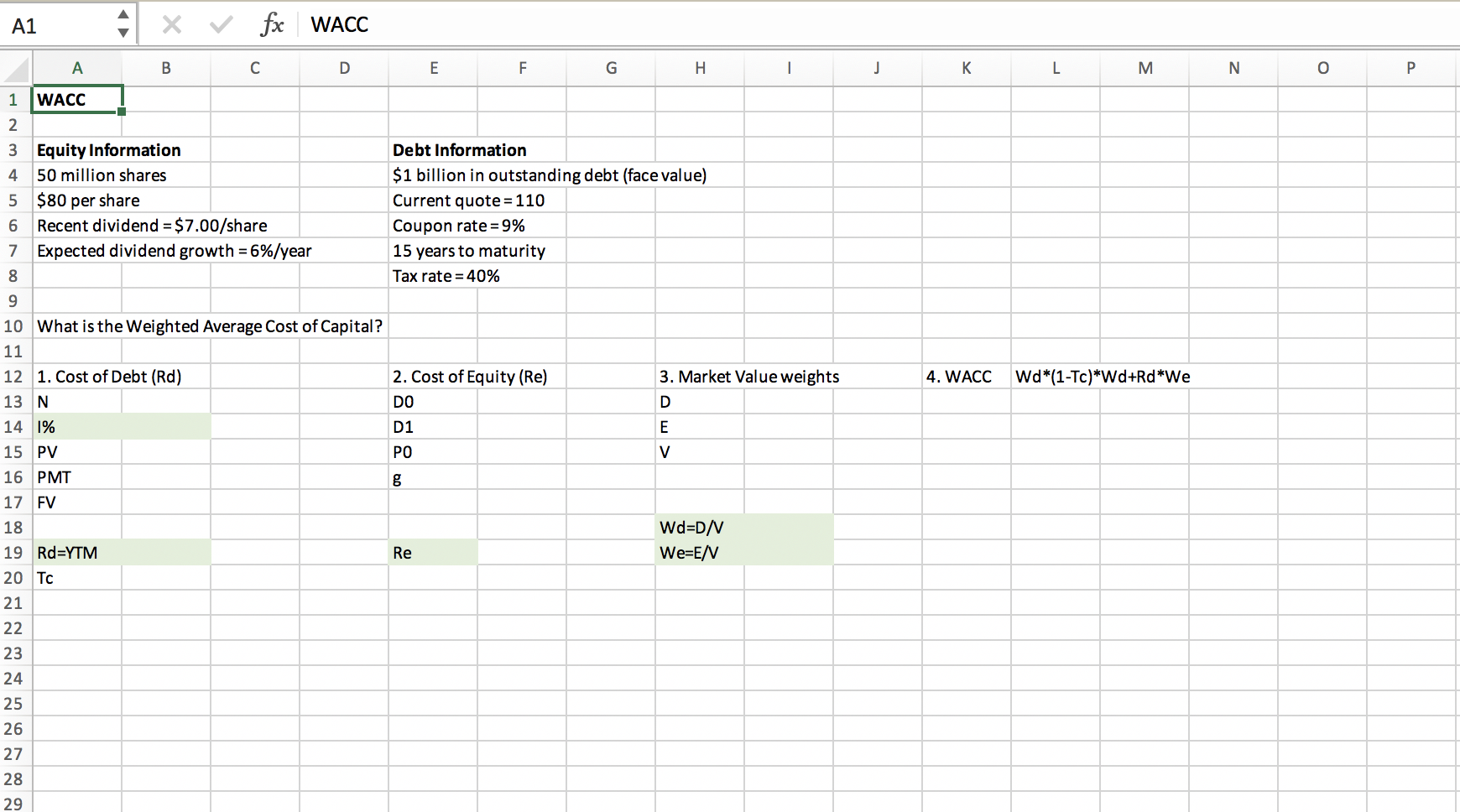

. A1 X V fx WACC A B D E F G H I j K L M N o 1 WACC 2 3 Equity Information 4 50 million shares 5 $80 per share 6 Recent dividend = $7.00/share 7 Expected dividend growth = 6%/year 8 Debt Information $1 billion in outstanding debt (face value) Current quote = 110 Coupon rate = 9% 15 years to maturity Tax rate = 40% 9 3. Market Value weights 4. WACC Wd*(1-Tc)*Wd+Rd*We 10 What is the Weighted Average Cost of Capital? 11 12 1. Cost of Debt (Rd) 13 N 14 1% 15 PV 2. Cost of Equity (Re) DO D E D1 PO V 16 PMT g Wd=DN We=EN Re 17 FV 18 19 Rd=YTM 20 TC 21 22 23 24 25 26 27 28 29

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts