Question: A3. This exercise is based on the CAPM model, as well as the Fama and French three factor and the four factor models. Three regressions

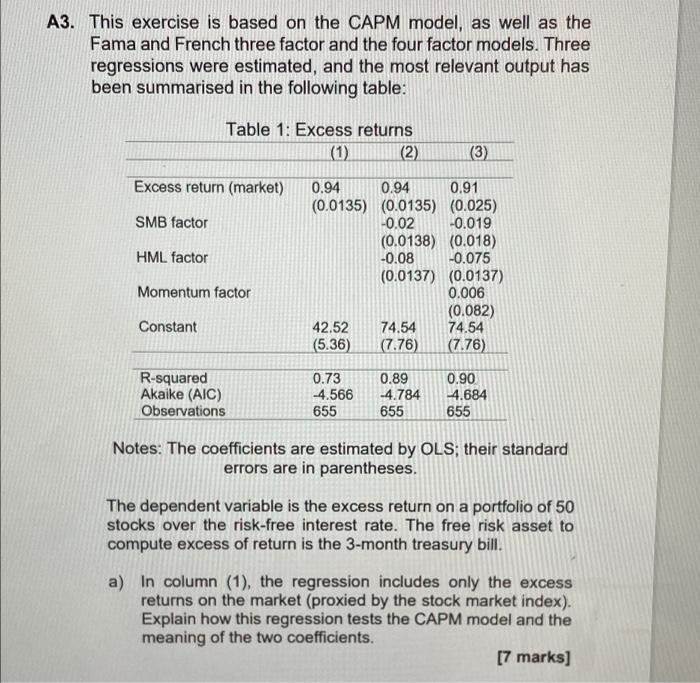

A3. This exercise is based on the CAPM model, as well as the Fama and French three factor and the four factor models. Three regressions were estimated, and the most relevant output has been summarised in the following table: Table 1: Excess returns (1) (2) (3) Excess return (market) SMB factor HML factor 0.94 0.94 0.91 (0.0135) (0.0135) (0.025) -0.02 -0.019 (0.0138) (0.018) -0.08 -0.075 (0.0137) (0.0137) 0.006 (0.082) 42.52 74.54 74.54 (5.36) (7.76) (7.76) Momentum factor Constant R-squared Akaike (AIC) Observations 0.73 4.566 655 0.89 -4.784 655 0.90 4.684 655 Notes: The coefficients are estimated by OLS; their standard errors are in parentheses. The dependent variable is the excess return on a portfolio of 50 stocks over the risk-free interest rate. The free risk asset to compute excess of return is the 3-month treasury bill. a) In column (1), the regression includes only the excess returns on the market (proxied by the stock market index). Explain how this regression tests the CAPM model and the meaning of the two coefficients. [7 marks] A3. This exercise is based on the CAPM model, as well as the Fama and French three factor and the four factor models. Three regressions were estimated, and the most relevant output has been summarised in the following table: Table 1: Excess returns (1) (2) (3) Excess return (market) SMB factor HML factor 0.94 0.94 0.91 (0.0135) (0.0135) (0.025) -0.02 -0.019 (0.0138) (0.018) -0.08 -0.075 (0.0137) (0.0137) 0.006 (0.082) 42.52 74.54 74.54 (5.36) (7.76) (7.76) Momentum factor Constant R-squared Akaike (AIC) Observations 0.73 4.566 655 0.89 -4.784 655 0.90 4.684 655 Notes: The coefficients are estimated by OLS; their standard errors are in parentheses. The dependent variable is the excess return on a portfolio of 50 stocks over the risk-free interest rate. The free risk asset to compute excess of return is the 3-month treasury bill. a) In column (1), the regression includes only the excess returns on the market (proxied by the stock market index). Explain how this regression tests the CAPM model and the meaning of the two coefficients. [7 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts