Question: ABC Construction C0. has two divisions that are run as separate profit centers, a general contracting group and a group that self-performs drywall and interior

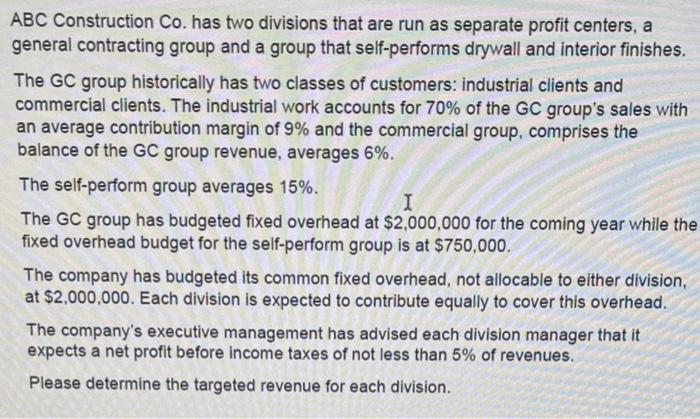

ABC Construction C0. has two divisions that are run as separate profit centers, a general contracting group and a group that self-performs drywall and interior finishes. The GC group historically has two classes of customers: industrial clients and commercial clients. The industrial work accounts for 70% of the GC group's sales with an average contribution margin of 9% and the commercial group, comprises the balance of the GC group revenue, averages 6%. The self-perform group averages 15%. The GC group has budgeted fixed overhead at $2,000,000 for the coming year while the fixed overhead budget for the self-perform group is at $750,000. The company has budgeted its common fixed overhead, not allocable to either division, at $2,000,000. Each division is expected to contribute equally to cover this overhead. The company's executive management has advised each division manager that it expects a net profit before income taxes of not less than 5% of revenues. Please determine the targeted revenue for each division

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts