Question: ABC construction Inc. is considering whether to purchase a Caterpillar backhoe or not. The cost of the backhoe is $47,410, the annual net benefit is

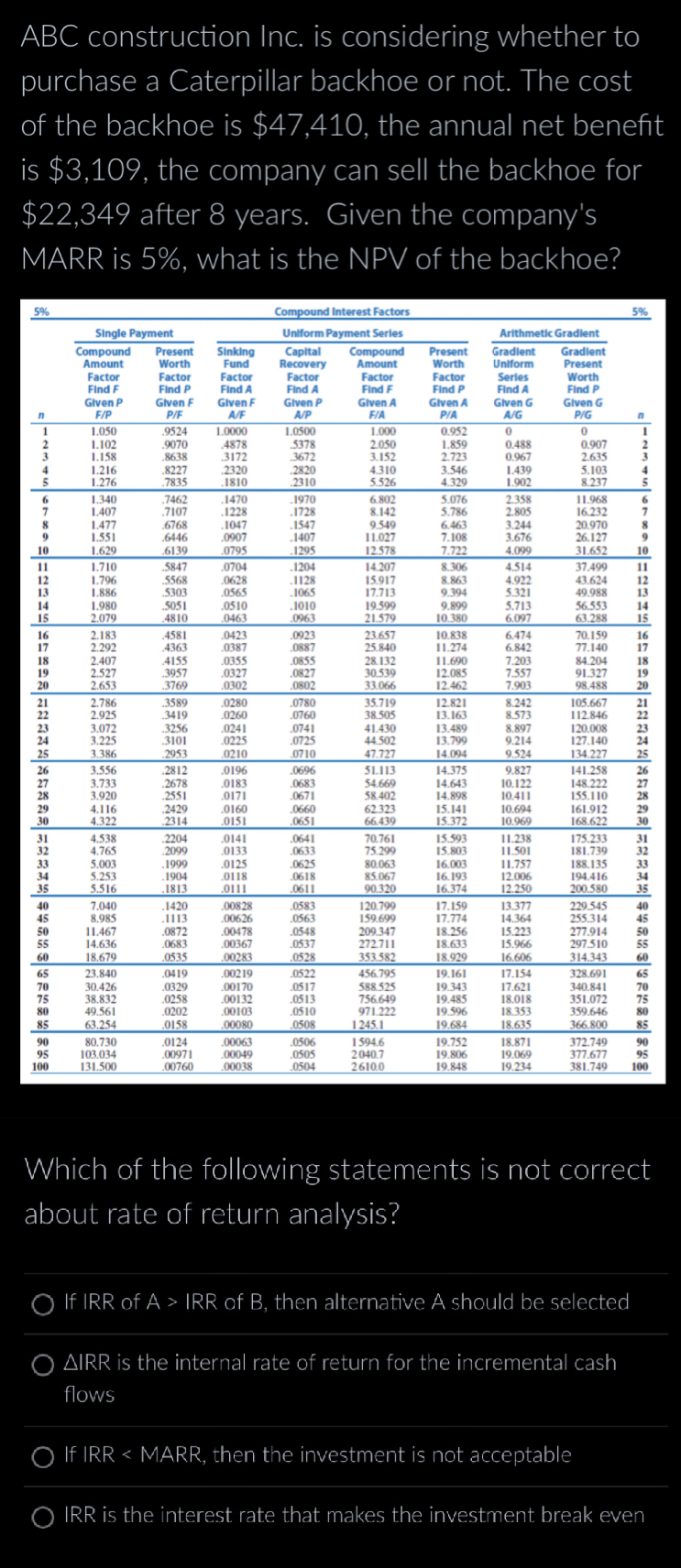

ABC construction Inc. is considering whether to purchase a Caterpillar backhoe or not. The cost of the backhoe is $47,410, the annual net benefit is $3,109, the company can sell the backhoe for $22,349 after 8 years. Given the company's MARR is 5%, what is the NPV of the backhoe? Which of the following statements is not correct about rate of return analysis? If IRR of A>IRR of B, then alternative A should be selected IRR is the internal rate of return for the incremental cash flows If IRR ABC construction Inc. is considering whether to purchase a Caterpillar backhoe or not. The cost of the backhoe is $47,410, the annual net benefit is $3,109, the company can sell the backhoe for $22,349 after 8 years. Given the company's MARR is 5%, what is the NPV of the backhoe? Which of the following statements is not correct about rate of return analysis? If IRR of A>IRR of B, then alternative A should be selected IRR is the internal rate of return for the incremental cash flows If IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts