Question: ABC Inc. is evaluating a 12-year task. The task requires a tool that costs $125,000 and has a CCA rate of 25%. The tool

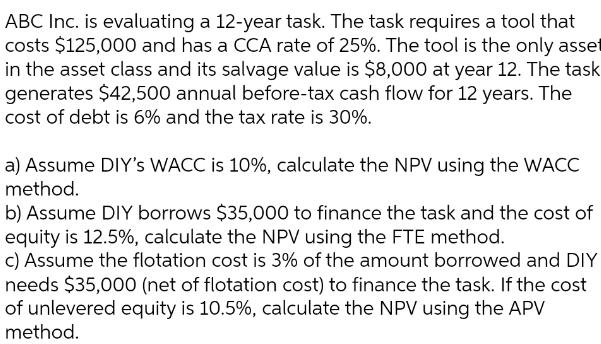

ABC Inc. is evaluating a 12-year task. The task requires a tool that costs $125,000 and has a CCA rate of 25%. The tool is the only asset in the asset class and its salvage value is $8,000 at year 12. The task generates $42,500 annual before-tax cash flow for 12 years. The cost of debt is 6% and the tax rate is 30%. a) Assume DIY's WACC is 10%, calculate the NPV using the WACC method. b) Assume DIY borrows $35,000 to finance the task and the cost of equity is 12.5%, calculate the NPV using the FTE method. c) Assume the flotation cost is 3% of the amount borrowed and DIY needs $35,000 (net of flotation cost) to finance the task. If the cost of unlevered equity is 10.5%, calculate the NPV using the APV method.

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

a To calculate the NPV using the WACC method we need to discount the cash flows at the weighted aver... View full answer

Get step-by-step solutions from verified subject matter experts