Question: AC3059_FM_Prelim_2007.pdf - Adobe Reader File Edit View Window Help 2 / 8 75% Tools Sign Comment 1 John Brown, after his skiing holiday in France

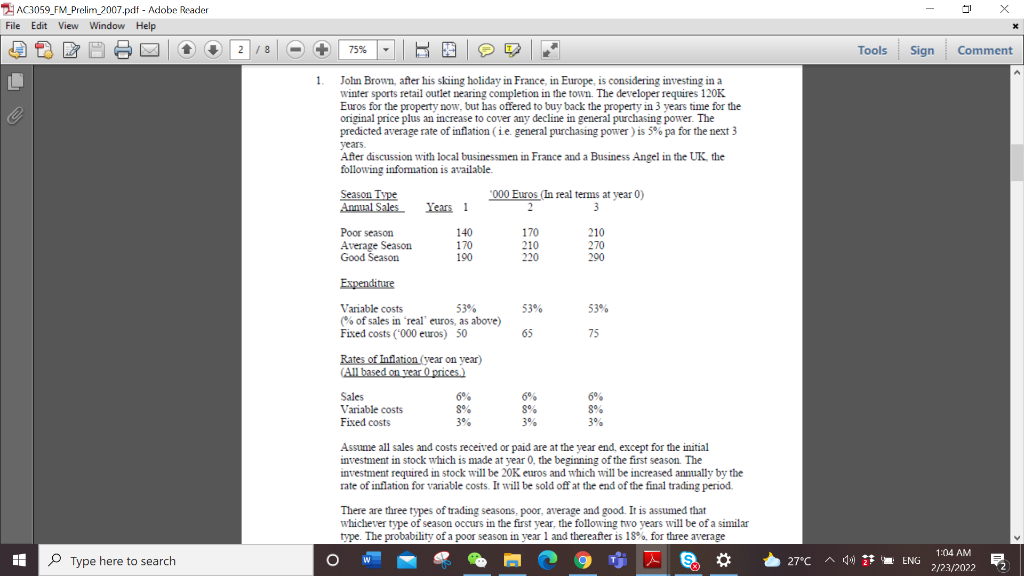

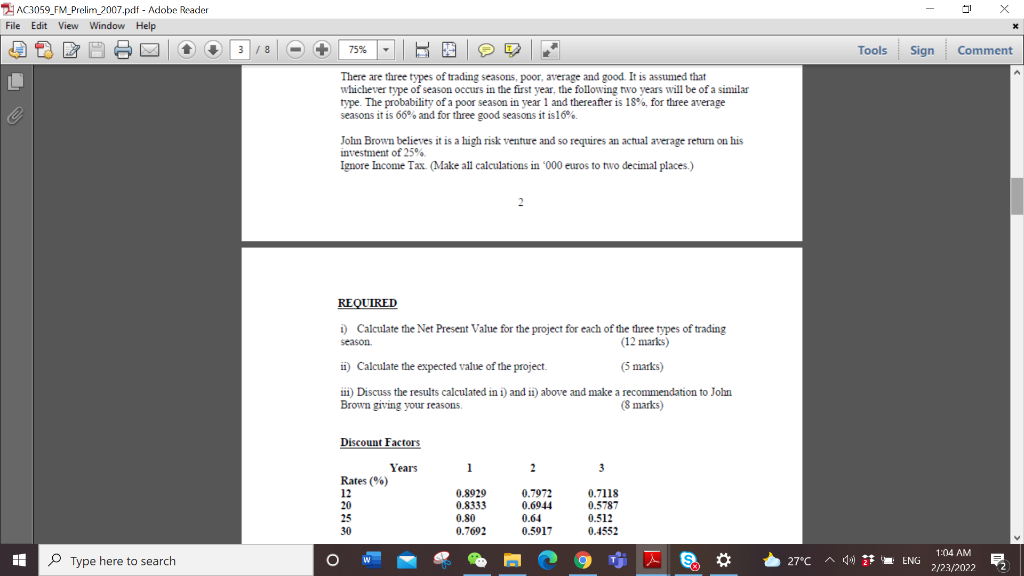

AC3059_FM_Prelim_2007.pdf - Adobe Reader File Edit View Window Help 2 / 8 75% Tools Sign Comment 1 John Brown, after his skiing holiday in France in Europe, is considering investing in a Winter Sports retail outlet nearing completion in the town. The developer requires 120K Euros for the property now, but has offered to buy back the property in 3 years time for the original price plus an increase to cover any decline in general purchasing power. The predicted average rate of inflation (ie general purchasing power) is 5% pa for the next 3 years After discussion with local businessmen in France and a Business Angel in the UK the following infomation is available Season Type 000 Euros (In real terms at year 0) Annual Sales Years 1 2 3 Poor season 140 170 210 Average Season 170 210 270 Good Season 190 220 290 Expenditure 53% 53% Variable costs 53% % of sales in real euros, as above) Fixed costs ("000 euros) 50 65 75 Rates of Inflation (year on year) (All based on year 0 prices.) Sales Variable costs Fixed costs 6% 8% 3% 6% 8% 3% 6% 8% 3% Assume all sales and costs received or paid are at the year end, except for the initial investment in stock which is made at year 0. the beginning of the first season. The investment required in stock will be 20 euros and which will be increased annually by the rate of inflation for variable costs. It will be sold off at the end of the final trading period. There are three types of trading seasons, poor, average and good. It is assumed that whichever type of season occurs in the first year, the following two years will be of a similar type. The probability of a poor season in year 1 and thereafter is 18%, for three average I Type here to search O T 27C AC ** ENG C 1:04 AM 2/23/2022 AC3059_FM_Prelim_2007.pdf - Adobe Reader File Edit View Window Help 1 3 / 8 75% BE Tools Sign Comment There are three types of trading seasons, poor, average and good. It is assumed that whichever type of season occurs in the first year, the following two years will be of a similar type. The probability of a poor season in year 1 and thereafter is 18%, for three average seasons it is 66% and for three good seasons it is16% John Brown believes it is a high risk venture and so requires an actual average return on his investment of 25% Ignore Income Tax. (Make all calculations in '000 euros to two decimal places.) REQUIRED 1) Calculate the Net Present Value for the project for each of the three types of trading season (12 marks) ii) Calculate the expected value of the project. (5 marks) (5 ) 111) Discuss the results calculated in i) and ii) above and make a recommendation to John Brown giving your reasons (8 marks) Discount Factors 1 2 3 Years Rates (%) 12 20 25 30 0.8929 0.8333 0.80 0.7692 0.7972 0.6944 0.64 0.5917 0.7118 0.5787 0.512 0.4552 I Type here to search O T S. 27C A ( ENG 1:04 AM 2/23/2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts