Question: Type or paste question here AC3059_FM_Prelim_2008.pdf - Adobe Reader File Edit View Window Help 2 / 8 75% B Tools Sign Comment SECTION A 1.

Type or paste question here

Type or paste question here

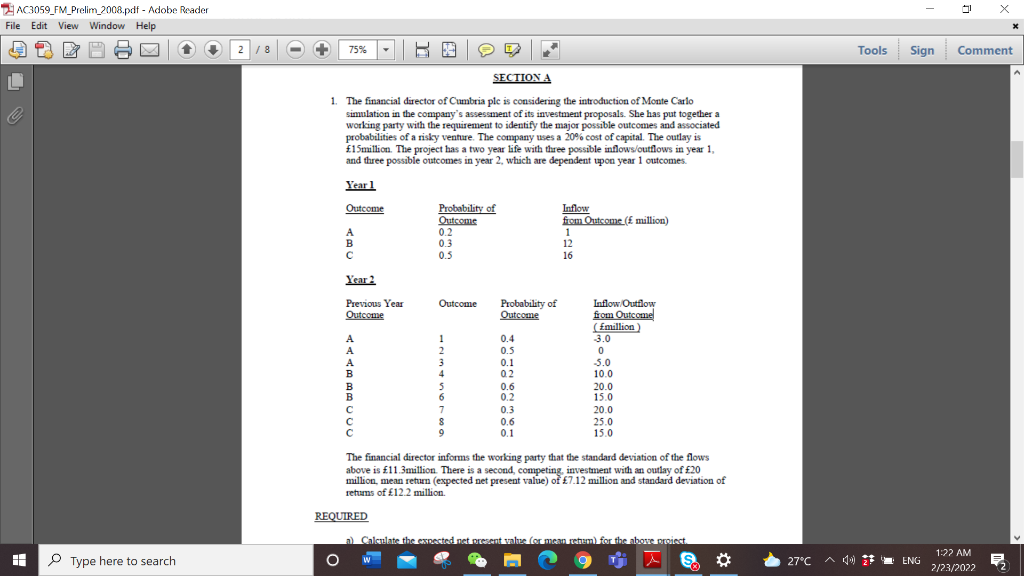

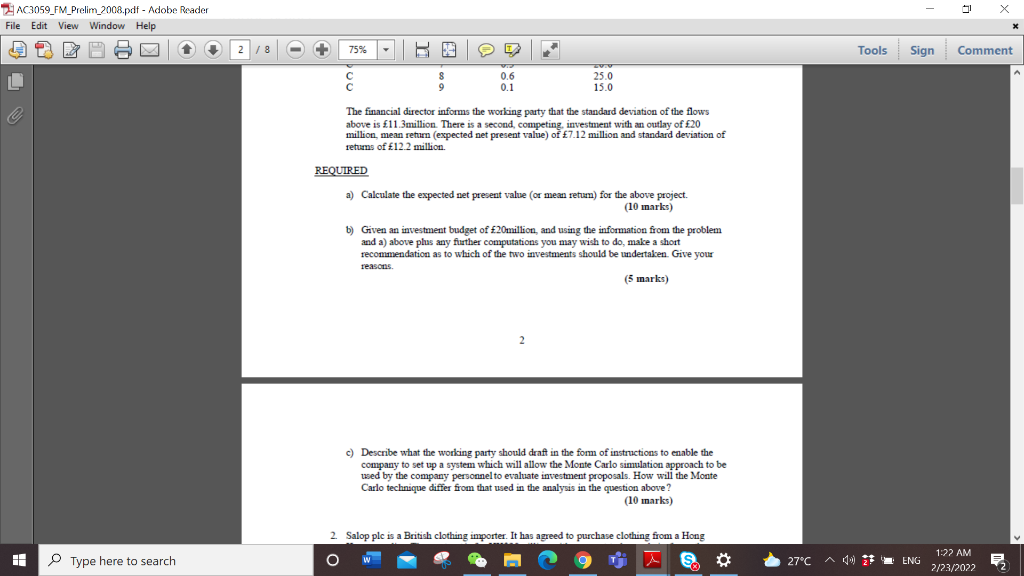

AC3059_FM_Prelim_2008.pdf - Adobe Reader File Edit View Window Help 2 / 8 75% B Tools Sign Comment SECTION A 1. The financial director of Cumbria plc is considering the introduction of Monte Carlo simulation in the company's assessment of its investment proposals. She has put together a working party with the requirement to identify the major possible outcomes and associated probabilities of a risky venture. The company uses a 20% cost of capital. The outlay is 15million. The project has a two year life with three possible inflows/outflows in year 1, and three possible outcomes in year 2. which are dependent upon year 1 outcomes. Yearl Outcome 6 A B Probability of Outcome 0.2 0.3 0.5 Inflow from Outcome. ( million) ) 1 12 16 Year 2 Outcome Previous Year Outcome Probability of Outcome 0.4 3 4 5 6 B B B Inflow Outflow from Outcome million 3.0 0 0 5.0 10.0 20.0 15.0 20.0 25.0 15.0 0.5 0.1 02 0.6 0.2 0.3 0.6 0.1 9 The financial director informs the working party that the standard deviation of the flows above is 11.3million. There is a second, competing investment with an outlay of 20 million, mean return (expected net present value) of 7.12 million and standard deviation of retums of 12.2 million REQUIRED Calculate the expected net present wakes (ar man rehem for the above it. I Type here to search O O T 27C A ( 1 ENG 1:22 AM 2/23/2022 AC3059_FM_Prelim_2008.pdf - Adobe Reader File Edit View Window Help 1 2 / 8 75% - B e Tools Sign Comment 8 8 9 0.6 0.1 25.0 15.0 The financial director informs the working party that the standard deviation of the flows above is 11.3million. There is a second, competing, investment with an outlay of 20 million, mean return (expected net present value) of 7.12 million and standard deviation of retums of 12.2 million. REQUIRED a) Calculate the expected net present value (or mean retum) for the above project. ( (10 marks) b) Given an investment budget of 20million and using the information from the problem and a) above plus any further computations you may wish to do, make a short recommendation as to which of the two investments should be undertaken. Give your reasons (5 marks) 2 c) Describe what the working party should draft in the form of instructions to enable the company to set up a system which will allow the Monte Carlo simulation approach to be used by the company personnel to evaluate investment proposals. How will the Monte Carlo technique differ from that used in the analysis in the question above? (10 marks) 2. Salop plc is a British clothing importer. It has agreed to purchase clothing from a Hong a O o w T I Type here to search 27C A07 ENG 1:22 AM 2/23/2022 AC3059_FM_Prelim_2008.pdf - Adobe Reader File Edit View Window Help 2 / 8 75% B Tools Sign Comment SECTION A 1. The financial director of Cumbria plc is considering the introduction of Monte Carlo simulation in the company's assessment of its investment proposals. She has put together a working party with the requirement to identify the major possible outcomes and associated probabilities of a risky venture. The company uses a 20% cost of capital. The outlay is 15million. The project has a two year life with three possible inflows/outflows in year 1, and three possible outcomes in year 2. which are dependent upon year 1 outcomes. Yearl Outcome 6 A B Probability of Outcome 0.2 0.3 0.5 Inflow from Outcome. ( million) ) 1 12 16 Year 2 Outcome Previous Year Outcome Probability of Outcome 0.4 3 4 5 6 B B B Inflow Outflow from Outcome million 3.0 0 0 5.0 10.0 20.0 15.0 20.0 25.0 15.0 0.5 0.1 02 0.6 0.2 0.3 0.6 0.1 9 The financial director informs the working party that the standard deviation of the flows above is 11.3million. There is a second, competing investment with an outlay of 20 million, mean return (expected net present value) of 7.12 million and standard deviation of retums of 12.2 million REQUIRED Calculate the expected net present wakes (ar man rehem for the above it. I Type here to search O O T 27C A ( 1 ENG 1:22 AM 2/23/2022 AC3059_FM_Prelim_2008.pdf - Adobe Reader File Edit View Window Help 1 2 / 8 75% - B e Tools Sign Comment 8 8 9 0.6 0.1 25.0 15.0 The financial director informs the working party that the standard deviation of the flows above is 11.3million. There is a second, competing, investment with an outlay of 20 million, mean return (expected net present value) of 7.12 million and standard deviation of retums of 12.2 million. REQUIRED a) Calculate the expected net present value (or mean retum) for the above project. ( (10 marks) b) Given an investment budget of 20million and using the information from the problem and a) above plus any further computations you may wish to do, make a short recommendation as to which of the two investments should be undertaken. Give your reasons (5 marks) 2 c) Describe what the working party should draft in the form of instructions to enable the company to set up a system which will allow the Monte Carlo simulation approach to be used by the company personnel to evaluate investment proposals. How will the Monte Carlo technique differ from that used in the analysis in the question above? (10 marks) 2. Salop plc is a British clothing importer. It has agreed to purchase clothing from a Hong a O o w T I Type here to search 27C A07 ENG 1:22 AM 2/23/2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts