Question: According to Sharpe's single index model, for each stock i, we have: R; = Alpha; + Beta; * RM + e, where Alpha; and Beta,

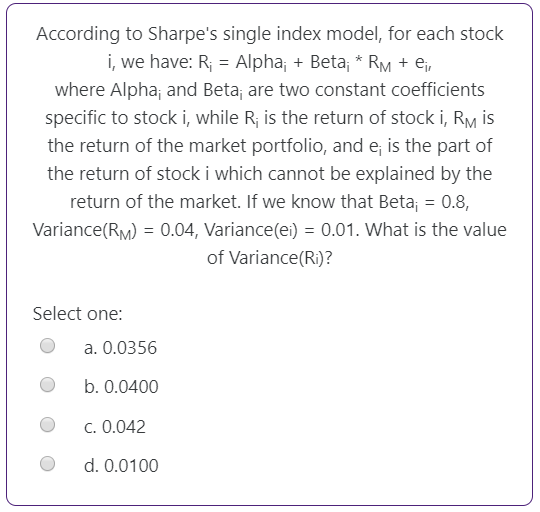

According to Sharpe's single index model, for each stock i, we have: R; = Alpha; + Beta; * RM + e, where Alpha; and Beta, are two constant coefficients specific to stock i, while R; is the return of stock i, RM is the return of the market portfolio, and e is the part of the return of stock i which cannot be explained by the return of the market. If we know that Beta; = 0.8, Variance(RM) = 0.04, Variance(ei) = 0.01. What is the value of Variance(Ri)? Select one: O a. 0.0356 b. 0.0400 C. 0.042 O d. 0.0100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts