Question: According to Sharpe's single index model, for each stock i, we have: R; = Alpha; + Beta; * RM + e, where Alpha; and Beta

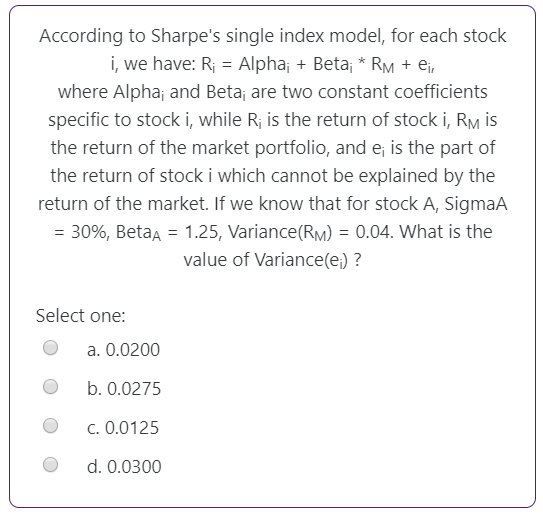

According to Sharpe's single index model, for each stock i, we have: R; = Alpha; + Beta; * RM + e, where Alpha; and Beta are two constant coefficients specific to stock i, while Ri is the return of stock i, RM is the return of the market portfolio, and e; is the part of the return of stock i which cannot be explained by the return of the market. If we know that for stock A, SigmaA = 30%, Betaa = 1.25, Variance(RM) = 0.04. What is the value of Variance(e;) ? Select one: O a. 0.0200 b. 0.0275 O C. 0.0125 d. 0.0300

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts