Question: Accounting 1 Help, PLEASE FOLLOW EXAMPLES BELOW BELOW IS THE EXAMPLE OF THE FORMAT FOR THE PROBLEM P1-2B Juanita Pierre opened a law office, on

Accounting 1 Help, PLEASE FOLLOW EXAMPLES BELOW

BELOW IS THE EXAMPLE OF THE FORMAT FOR THE PROBLEM

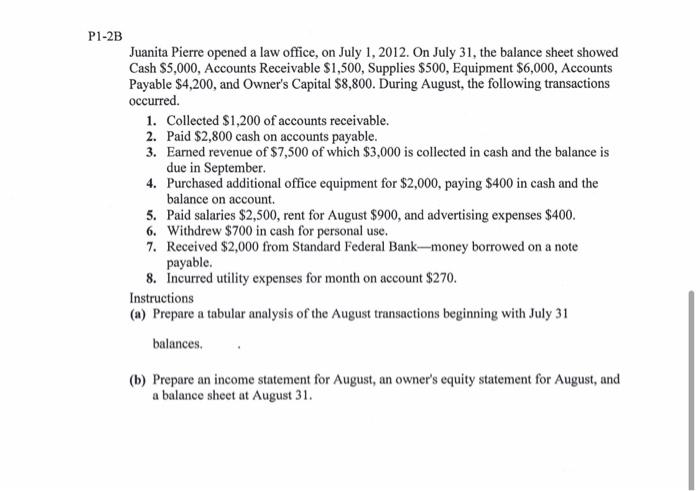

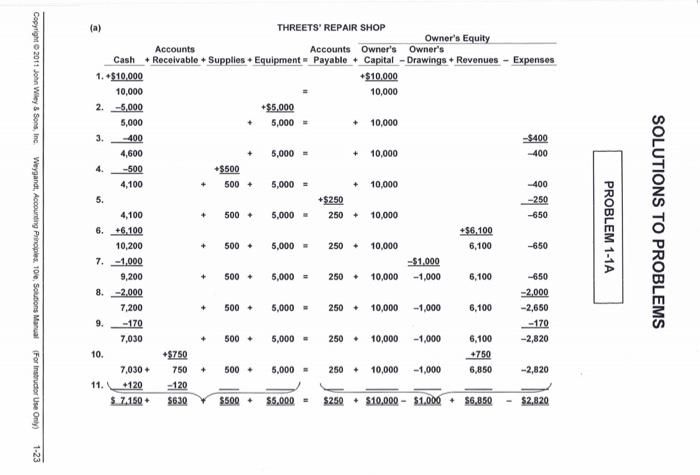

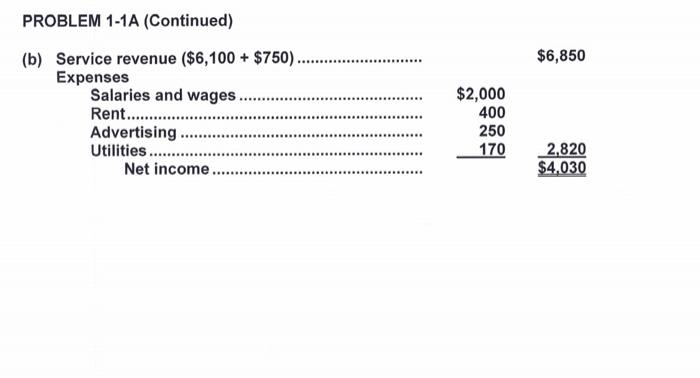

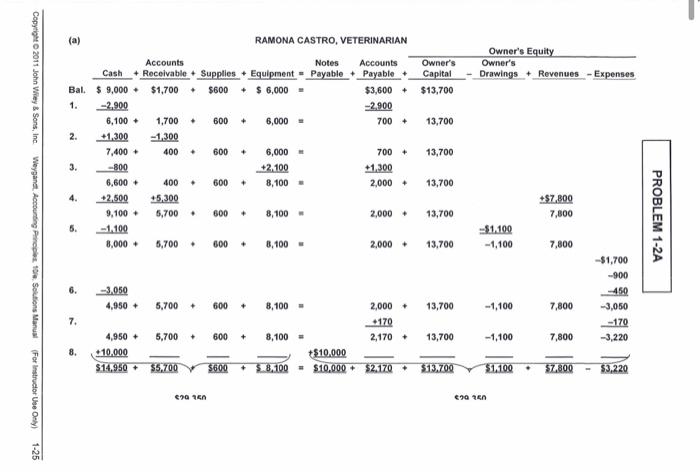

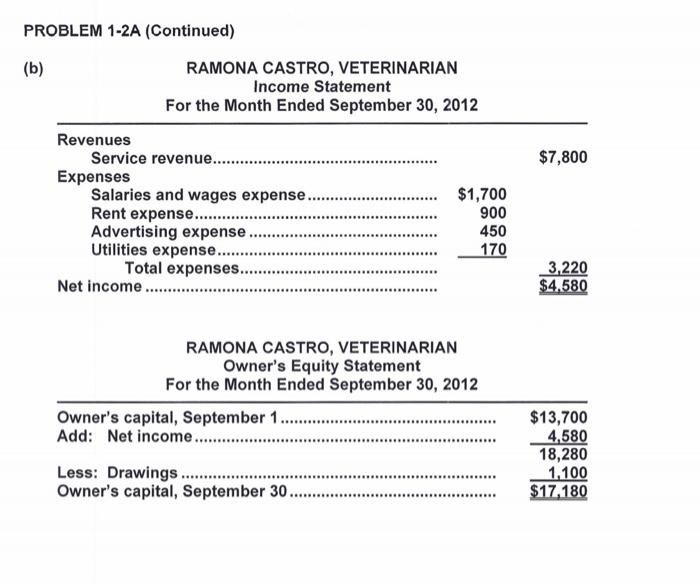

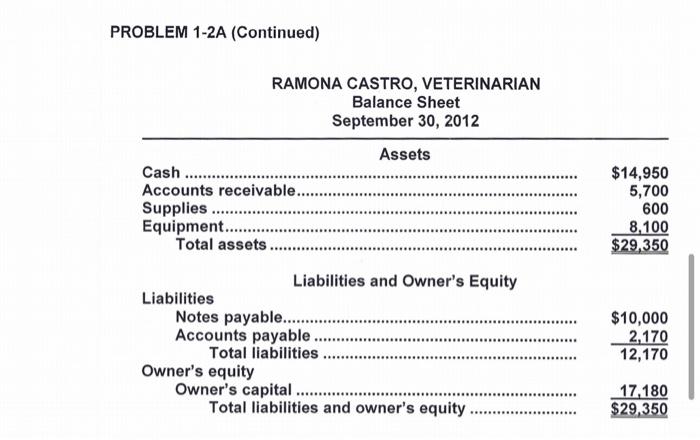

P1-2B Juanita Pierre opened a law office, on July 1, 2012. On July 31, the balance sheet showed Cash $5,000, Accounts Receivable $1,500, Supplies $500, Equipment $6,000, Accounts Payable $4,200, and Owner's Capital $8,800. During August, the following transactions occurred. 1. Collected $1,200 of accounts receivable. 2. Paid $2,800 cash on accounts payable. 3. Earned revenue of $7,500 of which $3,000 is collected in cash and the balance is due in September. 4. Purchased additional office equipment for $2,000, paying $400 in cash and the balance on account. 5. Paid salaries $2,500, rent for August $900, and advertising expenses $400. 6. Withdrew $ 700 in cash for personal use. 7. Received $2,000 from Standard Federal Bank-money borrowed on a note payable. 8. Incurred utility expenses for month on account $270. Instructions (a) Prepare a tabular analysis of the August transactions beginning with July 31 balances. (b) Prepare an income statement for August, an owner's equity statement for August, and a balance sheet at August 31. Copyright 2011 John Wiley & Sons, Inc + -500 (a) THREETS' REPAIR SHOP Owner's Equity Accounts Accounts Owner's Owner's Cash + Receivable + Supplies - Equipment Payable + Capital - Drawings + Revenues - Expenses 1. $10,000 +$10,000 10,000 10,000 2.-5.000 +$5,000 5,000 + 5,000 = + 10,000 3. 400 -$400 4,600 5,000 10,000 -400 4. +$500 4,100 500 + 5,000 - + 10,000 -400 5. +$250 -250 4,100 500 + 5,000 - 250 + 10,000 -650 6. +6.100 +$6.100 10,200 500 + 5,000 250 + 10,000 6.100 -650 7. -1,000 -$1.000 9,200 500 5,000 250 + 10,000 -1,000 6,100 -650 8.-2.000 -2,000 7,200 500 + 5,000 - 250 10,000 -1,000 6,100 -2,650 9.-170 -170 7,030 500 + 5,000 - 250 10,000 -1,000 6.100 -2,820 10. +$750 7,030 750 + 500 + 5,000 - 250 + 10,000 -1,000 6,850 -2,820 11. +120 -120 $. 7.150 $630 $500 $5,000 - $250 - $10,000 - $1,000+ $6,850 $2,820 + Weygandt, Accounting Principles, 10/, Solutions Manual PROBLEM 1-1A SOLUTIONS TO PROBLEMS + + + -750 (For instructor Use Only 1-23 PROBLEM 1-1A (Continued) $6,850 B. (b) Service revenue ($6,100 + $750). Expenses Salaries and wages. Rent....... Advertising Utilities ...... Net income $2,000 400 250 170 2.820 $4.030 Copyright 2011 John Wiley & Sons, Inc. Owner's Capital $13,700 Owner's Equity Owner's Drawings + Revenues - Expenses 13,700 (a) RAMONA CASTRO, VETERINARIAN Accounts Notes Accounts Cash Receivable - Supplies - Equipment - Payable Payable Bal. $ 9,000 $1,700 . $600 + $ 6,000 = $3,600+ 1. -2.900 -2.900 6,100 + 1,700 . 600 + 6,000 700 + 2. +1,300 -1.300 7,400 400 . 600 + 6,000 - 700 + 3. -800 +2.100 +1,300 6.600 + 400 . 600 8,100 2,000+ 4. +2.500 +5,300 9,100 5,700 600 + 8,100 2,000 + 5. 1.100 8,000 + 5,700 600 + 8,100 2,000+ 13,700 + 13,700 +$7,800 7,800 13,700 Weygant Accounting Pieces Solutions Manual PROBLEM 1-2A -51.100 -1,100 13.700 7,800 --3.050 4,950 -$1,700 -900 -450 -3,050 -170 -3,220 5,700 + 600 + 13,700 -1,100 7,800 7. 5,700 600 + 8,100 - 2,000+ +170 8,100 = 2,170 $10,000 3.8.100 = $10.000 + $2,170 13,700 -1,100 7,800 4,950 + +10.000 $14,950 8. 55,700 $600 + $13.709 $1,100 57,800 $3.220 (For Instructor Use Only) e90 15 99 en 1-25 PROBLEM 1-2A (Continued) (b) RAMONA CASTRO, VETERINARIAN Income Statement For the Month Ended September 30, 2012 Revenues Service revenue.... Expenses Salaries and wages expense. $1,700 Rent expense..... 900 Advertising expense 450 Utilities expense...... 170 Total expenses. Net income $7,800 E. . 3,220 $4.580 RAMONA CASTRO, VETERINARIAN Owner's Equity Statement For the Month Ended September 30, 2012 Owner's capital, September 1. Add: Net income...... Less: Drawings ....... Owner's capital, September 30. $13,700 4,580 18,280 1,100 $17.180 PROBLEM 1-2A (Continued) RAMONA CASTRO, VETERINARIAN Balance Sheet September 30, 2012 $14,950 5,700 600 8,100 $29,350 Assets Cash Accounts receivable.. Supplies ..... Equipment........... Total assets Liabilities and Owner's Equity Liabilities Notes payable........... Accounts payable ............... Total liabilities Owner's equity Owner's capital Total liabilities and owner's equity $10,000 2,170 12,170 ER HERE 17,180 $29,350 n

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts