Question: ) The optimization problem in Mean Variance Portfolio Optimization (MVO) entails either finding the portfolio w that has the highest expected return for a

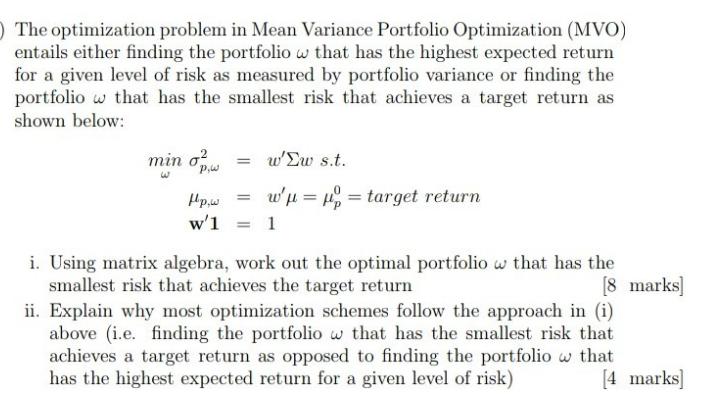

) The optimization problem in Mean Variance Portfolio Optimization (MVO) entails either finding the portfolio w that has the highest expected return for a given level of risk as measured by portfolio variance or finding the portfoliow that has the smallest risk that achieves a target return as shown below: min o W = w'Ew s.t. Hp,w w' == target return w'1 = 1 P,W = i. Using matrix algebra, work out the optimal portfolio w that has the smallest risk that achieves the target return [8 marks] ii. Explain why most optimization schemes follow the approach in (i) above (i.e. finding the portfolio w that has the smallest risk that achieves a target return as opposed to finding the portfolio w that has the highest expected return for a given level of risk) [4 marks]

Step by Step Solution

3.45 Rating (158 Votes )

There are 3 Steps involved in it

i Using matrix algebra work out the optimal portfolio w that has the smallest risk that achieves the target return Let be a column vector of expected returns be the covariance matrix of asset returns ... View full answer

Get step-by-step solutions from verified subject matter experts