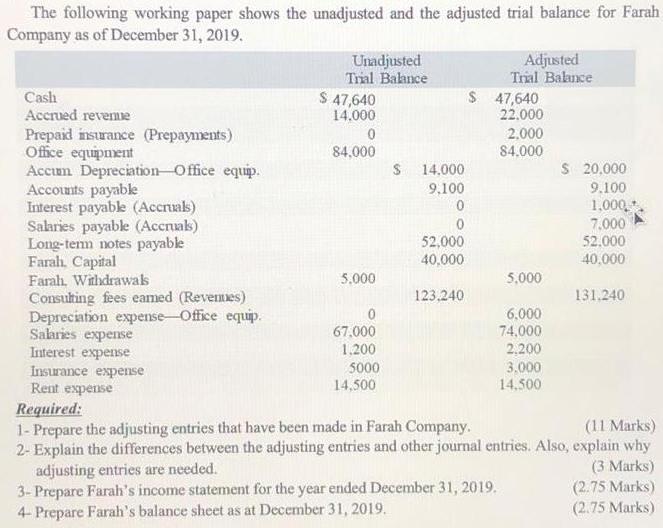

Question: The following working paper shows the unadjusted and the adjusted trial balance for Farah Company as of December 31, 2019. Unadjusted Trial Bahnce Adjusted

The following working paper shows the unadjusted and the adjusted trial balance for Farah Company as of December 31, 2019. Unadjusted Trial Bahnce Adjusted Tral Baknce Cash Accrued reveme S 47,640 14.000 $ 47,640 22,000 Prepaid insurance (Prepayments) Office equipment Accum Depreciation-Office equip. Accounts payabk Interest payable (Accruas) Salaries payable (Accnuak) Long-temm notes payable Farah. Capital Faralh, Withdrawaks Consulting fees eamed (Revenes) Depreciation expense-Office equip. Salaries expense Interest expense Insurance expense Rent expense 2.000 84.000 84,000 S 14,000 S 20.000 9,100 9.100 1,000,. 7.000 52,000 40.000 52,000 40,000 5.000 5,000 123,240 131.240 6,000 74,000 2,200 3,000 67.000 1,200 5000 14,500 14,500 Required: 1- Prepare the adjusting entries that have been made in Farah Company. 2- Explain the differences between the adjusting entries and other journal entries. Also, explain why adjusting entries are needed. 3- Prepare Farah's income statement for the year ended December 31, 2019. 4- Prepare Farah's balance sheet as at December 31, 2019. (11 Marks) (3 Marks) (2.75 Marks) (2.75 Marks)

Step by Step Solution

3.36 Rating (162 Votes )

There are 3 Steps involved in it

A djusting Eutries Partiulars Durt Credit Ca Accov... View full answer

Get step-by-step solutions from verified subject matter experts