Question: Accounting Problems Problem 1 Refer to Chapter 10 Q1.png, prepare the journal entry to record the exchange, assuming the transaction lacks commercial substance. Use the

Accounting Problems

Problem 1

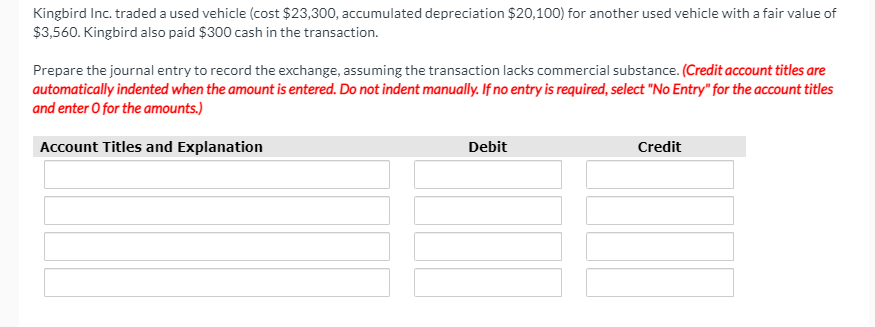

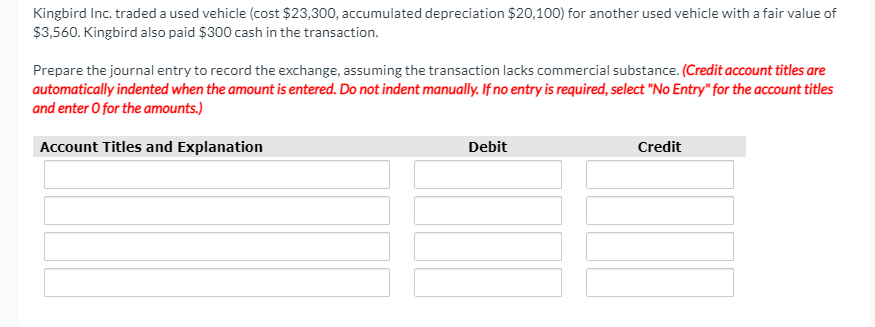

Refer to Chapter 10 Q1.png, prepare the journal entry to record the exchange, assuming the transaction lacks commercial substance. Use the list of accounts below.

List of Accounts

- Accounts Payable

- Accounts Receivable

- Accumulated Depreciation - Buildings

- Accumulated Depreciation - Equipment

- Accumulated Depreciation - Leasehold Improvements

- Accumulated Depreciation - Machinery

- Accumulated Depreciation - Vehicles

- Advertising Expense

- Asset Retirement Obligation

- Buildings

- Cash

- Common Shares

- Contributed Surplus

- Contributed Surplus - Donated Capital

- Cost of Goods Sold

- Deferred Revenue - Government Grants

- Depreciation Expense

- Donation Revenue

- Equipment

- Finance Expense

- Finance Revenue

- Gain or Loss in Value of Investment Property

- Gain on Disposal of Building

- Gain on Disposal of Equipment

- Gain on Disposal of Machinery

- Gain on Disposal of Vehicles

- GST Payable

- GST Receivable

- Interest Expense

- Interest Income

- Interest Payable

- Interest Receivable

- Inventory

- Investment Property

- Land

- Land Improvements

- Legal Expense

- Loss on Disposal of Building

- Loss on Disposal of Equipment

- Loss on Disposal of Land

- Loss on Disposal of Machinery

- Loss on Disposal of Vehicles

- Machinery

- Repairs and Maintenance Expense

- Mineral Resources

- Mortgage Payable

- No Entry

- Notes Payable

- Notes Receivable

- Office Expense

- Owner's Drawings

- Prepaid Expenses

- Prepaid Insurance

- Profit on Construction

- Purchase Discounts

- Purchase Returns and Allowances

- Rent Expense

- Revaluation Gain or Loss

- Revaluation Surplus (OCI)

- Revenue - Government Grants

- Salaries and Wages Expense

- Salaries and Wages Payable

- Sales Revenue

- Service Revenue

- Supplies

- Supplies Expense

- Tenant Deposits Liability

- Vehicles

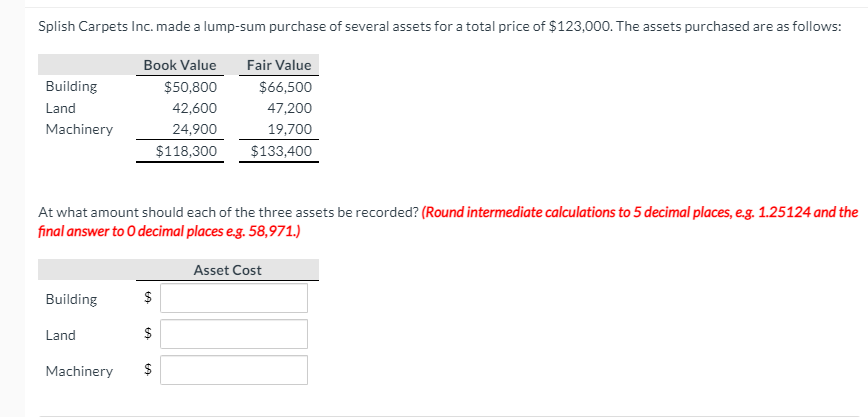

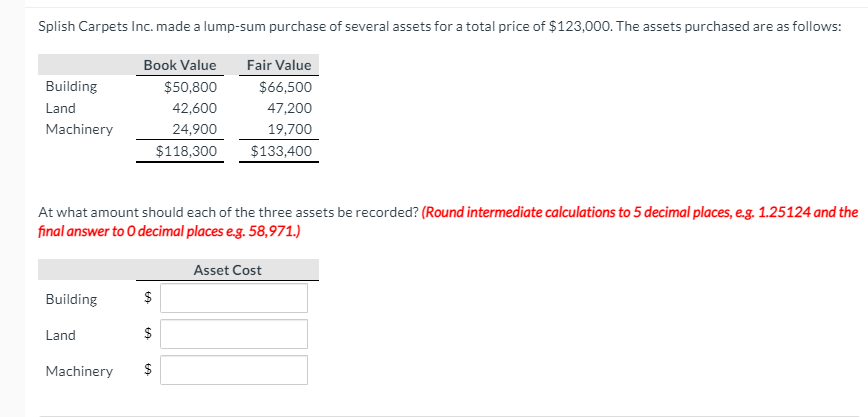

Kingbird Inc. traded a used vehicle (cost $23,300, accumulated depreciation $20,100) for another used vehicle with a fair value of $3,560. Kingbird also paid $300 cash in the transaction. Prepare the journal entry to record the exchange, assuming the transaction lacks commercial substance. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit CreditSplish Carpets Inc. made a lump-sum purchase of several assets for a total price of $123,000. The assets purchased are as follows: Book Value Fair Value Building $50,800 $66,500 Land 42,600 47,200 Machinery 24,900 19,700 $118,300 $133,400 At what amount should each of the three assets be recorded? (Round intermediate calculations to 5 decimal places, e.g. 1.25124 and the final answer to O decimal places e.g. 58,971.) Asset Cost Building Land S Machinery

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts