Question: Accounting Questin ANSWER ASAP PLS Question 3 10 points Save Answer Chapter 7 (9 marks, 18 minutes) On February 28, 2021, Burrow Ltd. had a

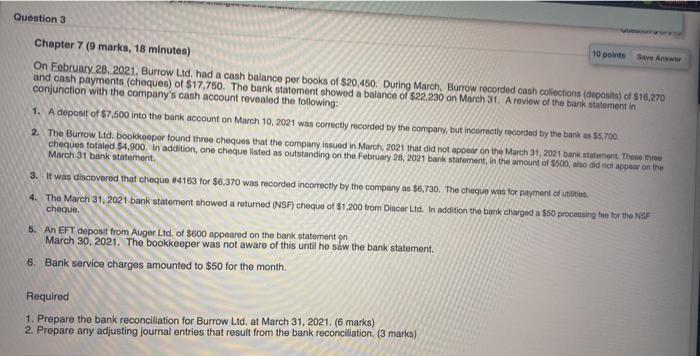

Question 3 10 points Save Answer Chapter 7 (9 marks, 18 minutes) On February 28, 2021, Burrow Ltd. had a cash balance per books of $20,450. During March, Burrow recorded cash collections (deposits) of 16,270 and cash payments (cheques) of $17.750. The bank statement showed a balance of $22, 230 on March 31. A review of the bank statement in conjunction with the company's cash account revealed the following: 1. A deposit of $7,500 into the bank account on March 10, 2021 was correctly recorded by the company, but incorrectly recorded by the bank as 55,700 2. The Burrow Lid. bookkeeper found three cheques that the company issued in March 2021 that did not appear on the March 31, 2021 bank statement. These cheques totaled $4,900. In addition, one cheque listed as outstanding on the February 28, 2021 bank statement in the amount of $500, so did not appear on the March 31 bank statement 3. It was discovered that cheque 14163 for $6,370 was recorded incorrectly by the company as $6,730. The cheque was for payment of it. 4. The March 31, 2021 bank statement showed a returned (NSF) cheque of $1.200 from Discar Ltd. In addition the bank charged a $50 processing fee for the NSF cheque 5. An EFT deposit from Auger Ltd. of $600 appeared on the bank statement on March 30, 2021. The bookkeeper was not aware of this until he saw the bank statement 6. Bank service charges amounted to $50 for the month. Required 1. Prepare the bank reconciliation for Burrow Ltd. at March 31, 2021. (6 marks) 2. Prepare any adjusting journal entries that result from the bank reconciliation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts