Question: ACCT 3232 C.D. Apples, Inc. CVP Analysis Case Study Fall 2019 C.D. Apples, Inc. produces two products from its apple orchards: apple juice (AJ) and

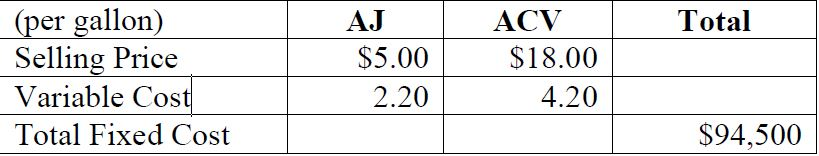

ACCT 3232 C.D. Apples, Inc. CVP Analysis Case Study Fall 2019 C.D. Apples, Inc. produces two products from its apple orchards: apple juice (AJ) and organic raw apple cider vinegar (ACV). The selling prices and costs for a gallon of each of the two products are provided in the table below: See Picture C.D. Apples sells four gallons of AJ for every one gallon of ACV. The company has a tax rate of 10%. REQUIRED: (a) What is the breakeven point (in units and dollars) for AJ and ACV given the stated sales mix of four gallons of AJ for every one gallon of ACV? (b) Assume that C.D. Apples tax rate increases to 12%. What would be the new breakeven point (in dollars) for each product? (c) Assume the company is considering implementing a new advertising campaign for ACV. They anticipate that the campaign will change the ratio of AJ to ACV from 4:1 to 2:1. The new campaign would increase total fixed costs by $4,440. (1) What would be the new breakeven point (in units and dollars) for each product? (2) How much will total sales increase or decrease if the new advertising campaign is implemented? (3) Should the new advertising campaign be implemented? Show how you reached your conclusion. Be sure you consider all of the amounts relevant to this decision. (d) Going back to the original information provided in the table above and the 4:1 ratio of AJ to ACV sales, how much of each product must be sold (in units) to make an after-tax profit of $85,050? Please show the calculations. Thank you.

C.D. Apples sells four gallons of AJ for every one gallon of ACV. The company has a tax rate of 10%. REQUIRED: (a) What is the breakeven point (in units and dollars) for AJ and ACV given the stated sales mix of four gallons of AJ for every one gallon of ACV? (b) Assume that C.D. Apples tax rate increases to 12%. What would be the new breakeven point (in dollars) for each product? (c) Assume the company is considering implementing a new advertising campaign for ACV. They anticipate that the campaign will change the ratio of AJ to ACV from 4:1 to 2:1. The new campaign would increase total fixed costs by $4,440. (1) What would be the new breakeven point (in units and dollars) for each product? (2) How much will total sales increase or decrease if the new advertising campaign is implemented? (3) Should the new advertising campaign be implemented? Show how you reached your conclusion. Be sure you consider all of the amounts relevant to this decision. (d) Going back to the original information provided in the table above and the 4:1 ratio of AJ to ACV sales, how much of each product must be sold (in units) to make an after-tax profit of $85,050? Please show the calculations. Thank you.

AJ Total (per gallon) Selling Price Variable Cost Total Fixed Cost $5.00 2.20 ACV $18.00 4.20 $94,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts