Question: ACE 346 Homework #2 Schedule A Tom and Lori Davis would like to itemize their deductions on the 2019 tax return. They have an adjusted

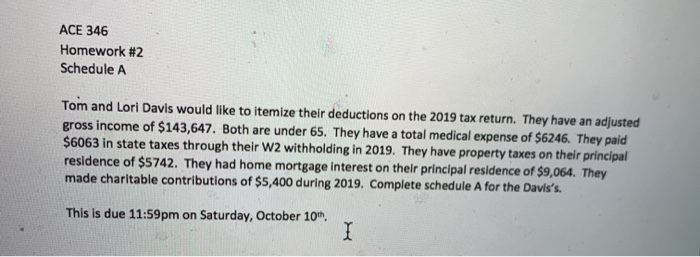

ACE 346 Homework #2 Schedule A Tom and Lori Davis would like to itemize their deductions on the 2019 tax return. They have an adjusted gross income of $143,647. Both are under 65. They have a total medical expense of $6246. They paid $6063 in state taxes through their W2 withholding in 2019. They have property taxes on their principal residence of $5742. They had home mortgage Interest on their principal residence of $9,064. They made charitable contributions of $5,400 during 2019. Complete schedule A for the Davis's. This is due 11:59pm on Saturday, October 10h

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock