Question: Questions: 6.1 & 6.2 PROBLEMS 6.1 You work at the currency desk at Barings Bank in London. As the middleman in a deal between the

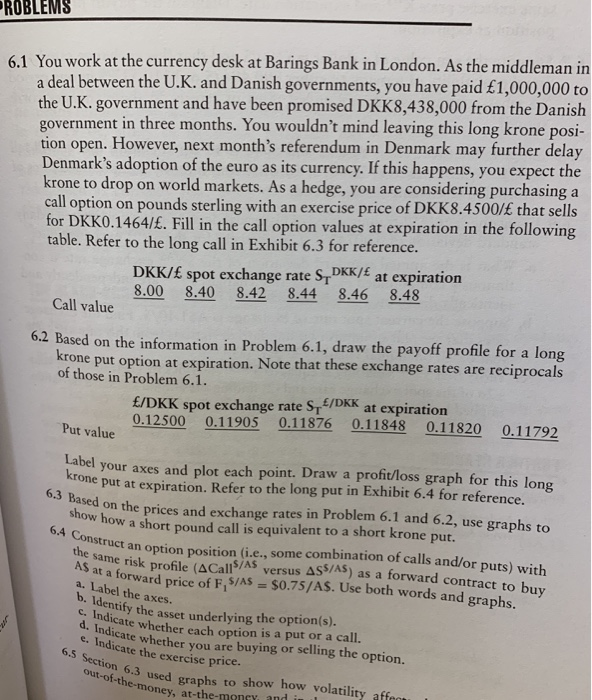

PROBLEMS 6.1 You work at the currency desk at Barings Bank in London. As the middleman in a deal between the U.K. and Danish governments, you have paid 1,000,000 to the U.K. government and have been promised DKK8,438,000 from the Danish government in three months. You wouldn't mind leaving this long krone posi- tion open. However, next month's referendum in Denmark may further delay Denmark's adoption of the euro as its currency. If this happens, you expect the krone to drop on world markets. As a hedge, you are considering purchasing a call option on pounds sterling with an exercise price of DKK8.4500/ that sells for DKK0.1464/. Fill in the call option values at expiration in the following table. Refer to the long call in Exhibit 6.3 for reference. DKK/ spot exchange rate S, DKK/ at expiration 8.00 8.40 8.42 8.44 8.46 8.48 Call value 6.2 Based on the information in Problem 6.1, draw the payoff profile for a long krone put option at expiration. Note that these exchange rates are reciprocals of those in Problem 6.1. /DKK spot exchange rate S/DKK at expiration 0.12500 0.11905 0.11876 0.11848 0.11820 0.11792 Put value 6.3 Based on the prices show how a short poun 6.4 Construct an op bel your axes and plot each point. Draw a profit/loss graph for this long rone put at expiration. Refer to the long put in Exhibit 6.4 for reference. ed on the prices and exchange rates in Problem 6.1 and 6.2, use graphs to now a short pound call is equivalent to a short krone put. instruct an option position (i.e., some combination of calls and/or puts) with Same risk profile (A CallS/AS versus ASS/AS) as a forward contra at a forward price of F, S/AS = $0.75/AS. Use both words and graphs. a. Label the axes. b. Identify the asse c. Indicate whether e d. Indicate whethe fy the asset underlying the option(s). ate whether each option is a put or a call. cate whether you are buying or selling the option. e. Indicate the exercise price. 6.5 Section 6.3 use out-of-the-money, 6.3 used graphs to show how volatility affect oney, at-the-money and im PROBLEMS 6.1 You work at the currency desk at Barings Bank in London. As the middleman in a deal between the U.K. and Danish governments, you have paid 1,000,000 to the U.K. government and have been promised DKK8,438,000 from the Danish government in three months. You wouldn't mind leaving this long krone posi- tion open. However, next month's referendum in Denmark may further delay Denmark's adoption of the euro as its currency. If this happens, you expect the krone to drop on world markets. As a hedge, you are considering purchasing a call option on pounds sterling with an exercise price of DKK8.4500/ that sells for DKK0.1464/. Fill in the call option values at expiration in the following table. Refer to the long call in Exhibit 6.3 for reference. DKK/ spot exchange rate S, DKK/ at expiration 8.00 8.40 8.42 8.44 8.46 8.48 Call value 6.2 Based on the information in Problem 6.1, draw the payoff profile for a long krone put option at expiration. Note that these exchange rates are reciprocals of those in Problem 6.1. /DKK spot exchange rate S/DKK at expiration 0.12500 0.11905 0.11876 0.11848 0.11820 0.11792 Put value 6.3 Based on the prices show how a short poun 6.4 Construct an op bel your axes and plot each point. Draw a profit/loss graph for this long rone put at expiration. Refer to the long put in Exhibit 6.4 for reference. ed on the prices and exchange rates in Problem 6.1 and 6.2, use graphs to now a short pound call is equivalent to a short krone put. instruct an option position (i.e., some combination of calls and/or puts) with Same risk profile (A CallS/AS versus ASS/AS) as a forward contra at a forward price of F, S/AS = $0.75/AS. Use both words and graphs. a. Label the axes. b. Identify the asse c. Indicate whether e d. Indicate whethe fy the asset underlying the option(s). ate whether each option is a put or a call. cate whether you are buying or selling the option. e. Indicate the exercise price. 6.5 Section 6.3 use out-of-the-money, 6.3 used graphs to show how volatility affect oney, at-the-money and im

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts