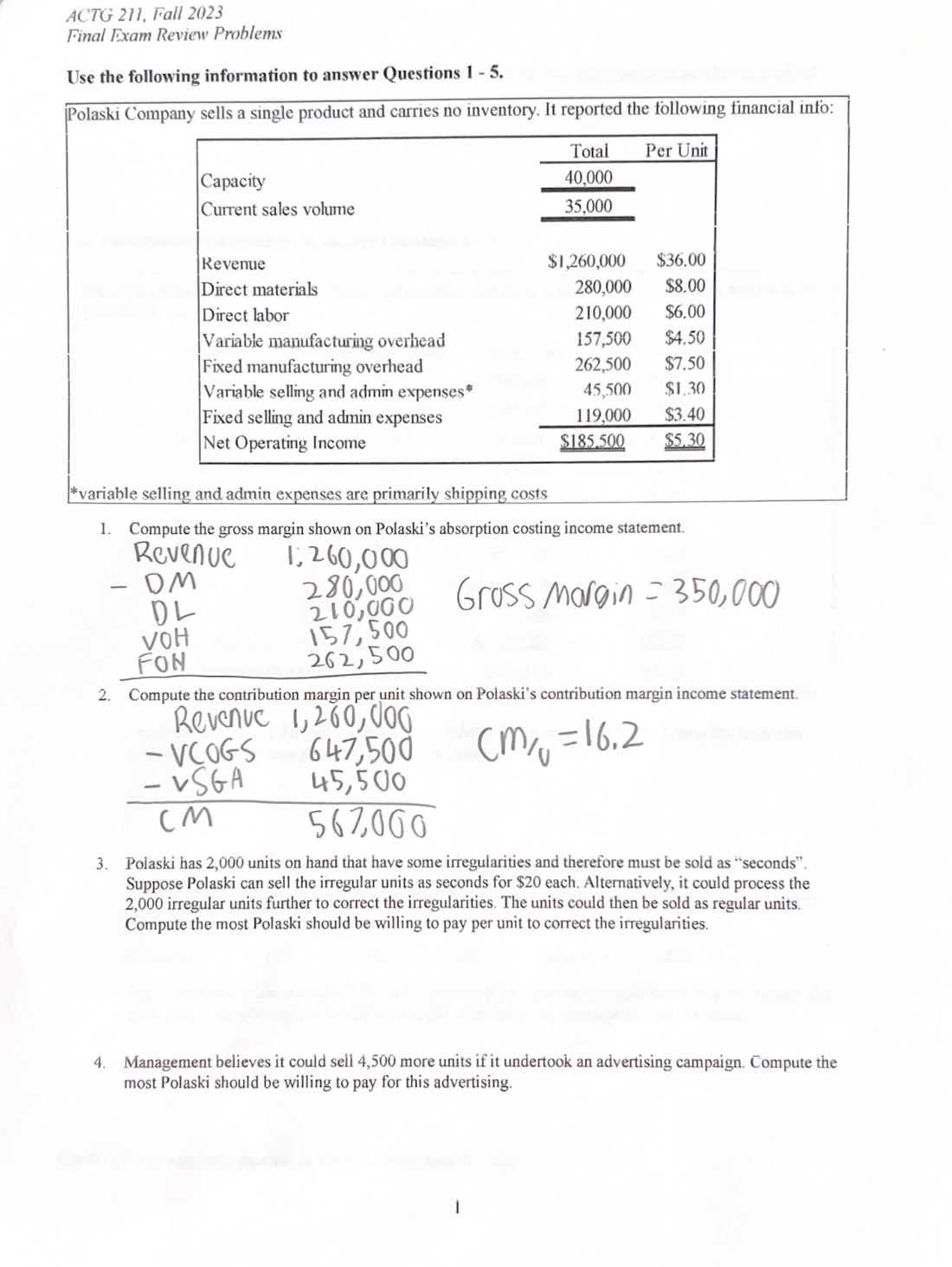

Question: ACTG 211, Fall 2023 Final Exam Review Problems Use the following information to answer Questions 1 - 5. Polaski Company sells a single product

ACTG 211, Fall 2023 Final Exam Review Problems Use the following information to answer Questions 1 - 5. Polaski Company sells a single product and carries no inventory. It reported the following financial info: Per Unit Capacity Current sales volume VOH FON Revenue Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Variable selling and admin expenses* Fixed selling and admin expenses Net Operating Income Total 40,000 35,000 $1,260,000 $36.00 $8.00 $6.00 $4.50 $7.50 $1.30 -VCOGS - VSGA CM 280,000 210,000 157,500 262,500 45,500 119,000 *variable selling and admin expenses are primarily shipping costs 1. Compute the gross margin shown on Polaski's absorption costing income statement. Revenue DM DL 1,260,000 280,000 210,000 157,500 262,500 $3.40 $185,500 $5.30 Gross Margin=350,000 2. Compute the contribution margin per unit shown on Polaski's contribution margin income statement. Revenue 1,260,000 647,500 Cm, = 16.2 45,500 562000 3. Polaski has 2,000 units on hand that have some irregularities and therefore must be sold as "seconds". Suppose Polaski can sell the irregular units as seconds for $20 each. Alternatively, it could process the 2,000 irregular units further to correct the irregularities. The units could then be sold as regular units. Compute the most Polaski should be willing to pay per unit to correct the irregularities. 4. Management believes it could sell 4,500 more units if it undertook an advertising campaign. Compute the most Polaski should be willing to pay for this advertising.

Step by Step Solution

3.44 Rating (147 Votes )

There are 3 Steps involved in it

1 Gross margin The gross margin is the difference between revenue and the cost of goods sold COGS Under absorption costing COGS includes all variable ... View full answer

Get step-by-step solutions from verified subject matter experts