Question: Action Items 1. Access McGraw-Hill Connect to begin this assignment. 2. Locate the folder named Week 11 inside the Connect platform and read the discussion

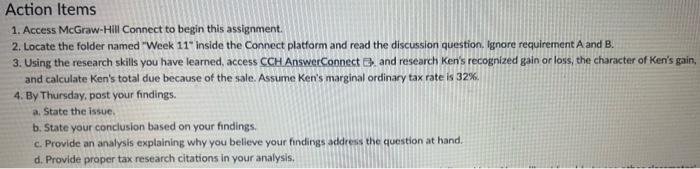

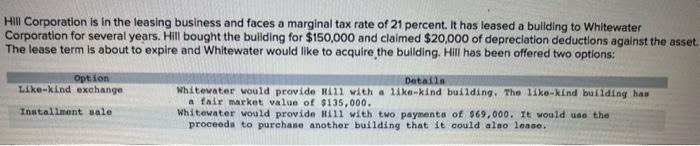

Action Items 1. Access McGraw-Hill Connect to begin this assignment. 2. Locate the folder named "Week 11 inside the Connect platform and read the discussion question. Ignore requirement A and B. 3. Using the research skills you have learned, access CCH AnswerConnect B. and research Ken's recognized gain or loss, the character of Ken's gain, and calculate Ken's total due because of the sale. Assume Ken's marginal ordinary tax rate is 32%. 4. By Thursday, post your findings. a. State the issue. b. State your conclusion based on your findings. c. Provide an analysis explaining why you believe your findings address the question at hand. d. Provide proper tax research citations in your analysis. Hill Corporation is in the leasing business and faces a marginal tax rate of 21 percent. It has leased a buliding to Whitewater Corporation for several years. Hill bought the bullding for $150,000 and claimed $20,000 of depreciation deductions against the asset. The lease term is about to expire and Whitewater would like to acquire the building. Hill has been offered two options

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts