Question: Actuarial Math/ Financial Math Problem: Binomial Tree Pricing Model Problem 1 (Required, 25 marks) (a) We consider an American put option on a non-dividend paying

Actuarial Math/ Financial Math Problem: Binomial Tree Pricing Model

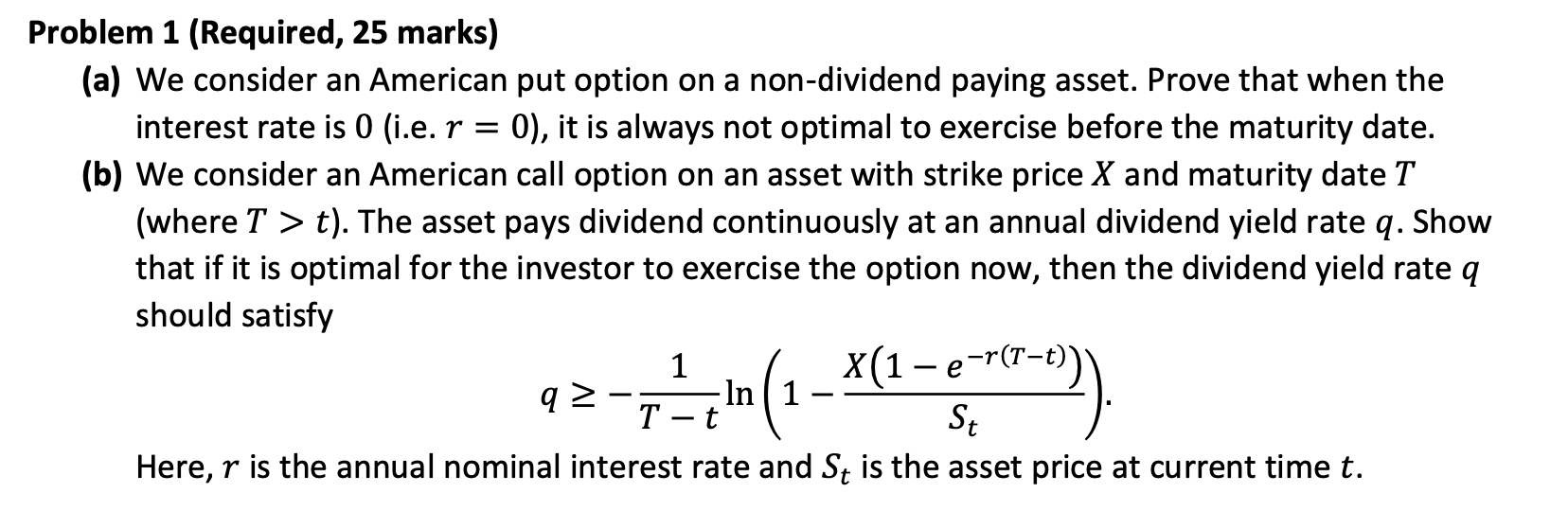

Problem 1 (Required, 25 marks) (a) We consider an American put option on a non-dividend paying asset. Prove that when the interest rate is 0 (i.e. r = 0), it is always not optimal to exercise before the maturity date. (b) We consider an American call option on an asset with strike price X and maturity date T (where T > t). The asset pays dividend continuously at an annual dividend yield rate q. Show that if it is optimal for the investor to exercise the option now, then the dividend yield rate q should satisfy 1 X(1-e - In 1 T-t St Here, r is the annual nominal interest rate and St is the asset price at current time t. q> Problem 1 (Required, 25 marks) (a) We consider an American put option on a non-dividend paying asset. Prove that when the interest rate is 0 (i.e. r = 0), it is always not optimal to exercise before the maturity date. (b) We consider an American call option on an asset with strike price X and maturity date T (where T > t). The asset pays dividend continuously at an annual dividend yield rate q. Show that if it is optimal for the investor to exercise the option now, then the dividend yield rate q should satisfy 1 X(1-e - In 1 T-t St Here, r is the annual nominal interest rate and St is the asset price at current time t. q>

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts