Question: Financial Math Problem: Binomial Tree Pricing Model Problem 4 (Required, 25 marks) The current price of a company stock is $100. The stock pays a

Financial Math Problem: Binomial Tree Pricing Model

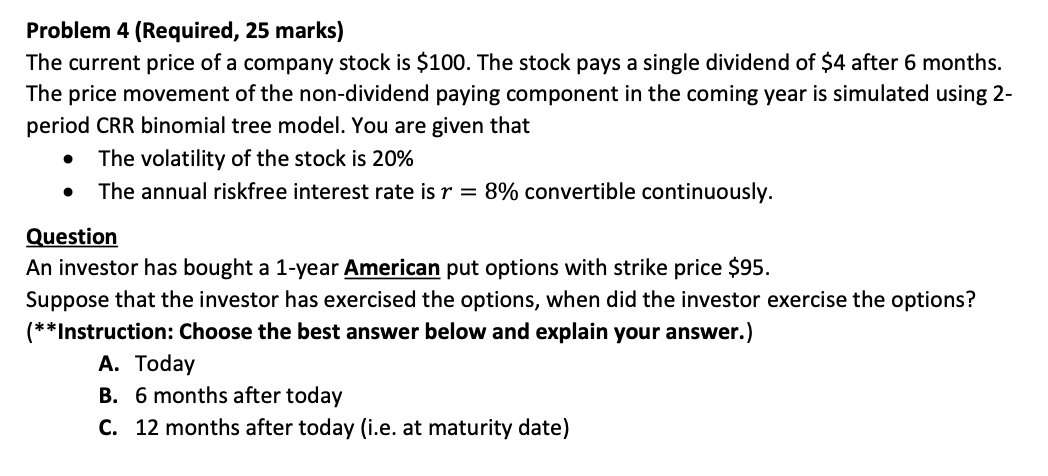

Problem 4 (Required, 25 marks) The current price of a company stock is $100. The stock pays a single dividend of $4 after 6 months. The price movement of the non-dividend paying component in the coming year is simulated using 2- period CRR binomial tree model. You are given that The volatility of the stock is 20% The annual riskfree interest rate is r = 8% convertible continuously. . Question An investor has bought a 1-year American put options with strike price $95. Suppose that the investor has exercised the options, when did the investor exercise the options? (**Instruction: Choose the best answer below and explain your answer.) A. Today B. 6 months after today C. 12 months after today (i.e. at maturity date) Problem 4 (Required, 25 marks) The current price of a company stock is $100. The stock pays a single dividend of $4 after 6 months. The price movement of the non-dividend paying component in the coming year is simulated using 2- period CRR binomial tree model. You are given that The volatility of the stock is 20% The annual riskfree interest rate is r = 8% convertible continuously. . Question An investor has bought a 1-year American put options with strike price $95. Suppose that the investor has exercised the options, when did the investor exercise the options? (**Instruction: Choose the best answer below and explain your answer.) A. Today B. 6 months after today C. 12 months after today (i.e. at maturity date)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts