Question: Additional Deferred Tax Handout James Cor. is in its first year of operations. The company has pretax income of $400,000. The company has the following

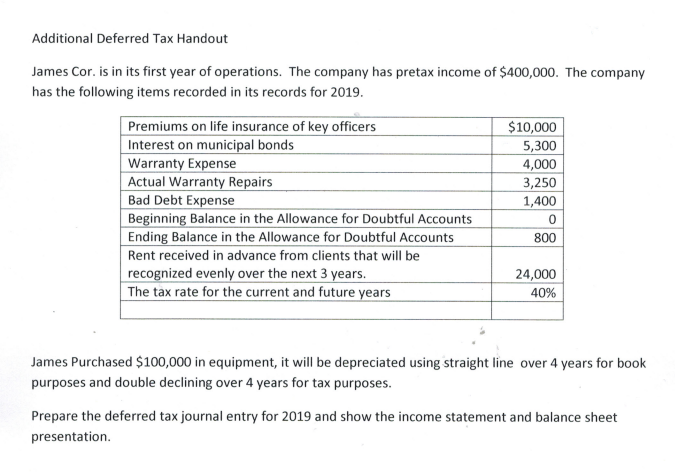

Additional Deferred Tax Handout James Cor. is in its first year of operations. The company has pretax income of $400,000. The company has the following items recorded in its records for 2019. $10,000 5,300 4,000 3,250 1,400 Premiums on life insurance of key officers Interest on municipal bonds Warranty Expense Actual Warranty Repairs Bad Debt Expense Beginning Balance in the Allowance for Doubtful Accounts Ending Balance in the Allowance for Doubtful Accounts Rent received in advance from clients that will be recognized evenly over the next 3 years. The tax rate for the current and future years 800 24,000 40% James Purchased $100,000 in equipment, it will be depreciated using straight line over 4 years for book purposes and double declining over 4 years for tax purposes. Prepare the deferred tax journal entry for 2019 and show the income statement and balance sheet presentation. Additional Deferred Tax Handout James Cor. is in its first year of operations. The company has pretax income of $400,000. The company has the following items recorded in its records for 2019. $10,000 5,300 4,000 3,250 1,400 Premiums on life insurance of key officers Interest on municipal bonds Warranty Expense Actual Warranty Repairs Bad Debt Expense Beginning Balance in the Allowance for Doubtful Accounts Ending Balance in the Allowance for Doubtful Accounts Rent received in advance from clients that will be recognized evenly over the next 3 years. The tax rate for the current and future years 800 24,000 40% James Purchased $100,000 in equipment, it will be depreciated using straight line over 4 years for book purposes and double declining over 4 years for tax purposes. Prepare the deferred tax journal entry for 2019 and show the income statement and balance sheet presentation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts