Question: undefined Additional Deferred Tax Handout James Cor. is in its first year of operations. The company has pretax income of $400,000. The company has the

undefined

undefined

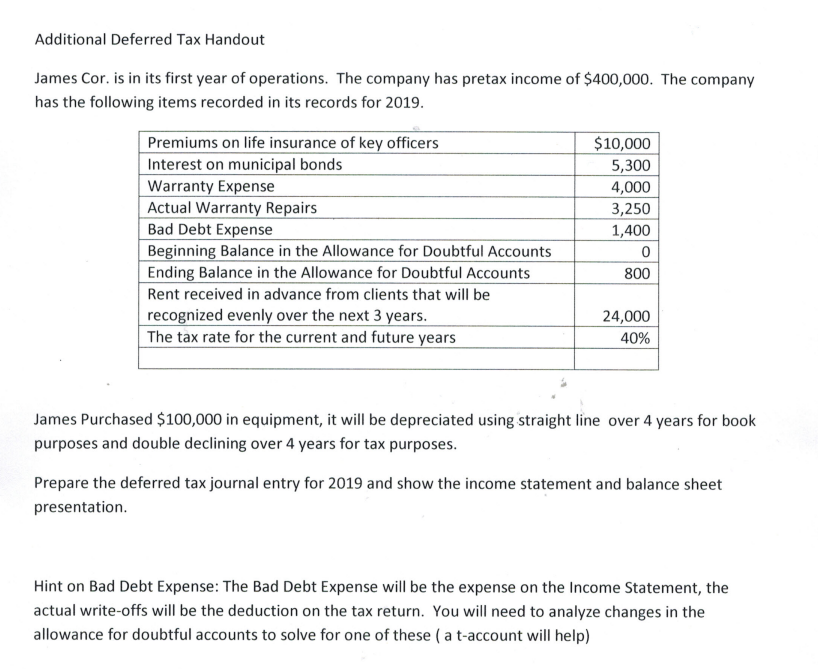

Additional Deferred Tax Handout James Cor. is in its first year of operations. The company has pretax income of $400,000. The company has the following items recorded in its records for 2019. Premiums on life insurance of key officers $10,000 Interest on municipal bonds 5,300 Warranty Expense 4,000 Actual Warranty Repairs 3,250 Bad Debt Expense 1,400 Beginning Balance in the Allowance for Doubtful Accounts 0 Ending Balance in the Allowance for Doubtful Accounts 800 Rent received in advance from clients that will be recognized evenly over the next 3 years. 24,000 The tax rate for the current and future years 40% James Purchased $100,000 in equipment, it will be depreciated using straight line over 4 years for book purposes and double declining over 4 years for tax purposes. Prepare the deferred tax journal entry for 2019 and show the income statement and balance sheet presentation. Hint on Bad Debt Expense: The Bad Debt Expense will be the expense on the Income Statement, the actual write-offs will be the deduction on the tax return. You will need to analyze changes in the allowance for doubtful accounts to solve for one of these ( a t-account will help) Additional Deferred Tax Handout James Cor. is in its first year of operations. The company has pretax income of $400,000. The company has the following items recorded in its records for 2019. Premiums on life insurance of key officers $10,000 Interest on municipal bonds 5,300 Warranty Expense 4,000 Actual Warranty Repairs 3,250 Bad Debt Expense 1,400 Beginning Balance in the Allowance for Doubtful Accounts 0 Ending Balance in the Allowance for Doubtful Accounts 800 Rent received in advance from clients that will be recognized evenly over the next 3 years. 24,000 The tax rate for the current and future years 40% James Purchased $100,000 in equipment, it will be depreciated using straight line over 4 years for book purposes and double declining over 4 years for tax purposes. Prepare the deferred tax journal entry for 2019 and show the income statement and balance sheet presentation. Hint on Bad Debt Expense: The Bad Debt Expense will be the expense on the Income Statement, the actual write-offs will be the deduction on the tax return. You will need to analyze changes in the allowance for doubtful accounts to solve for one of these ( a t-account will help)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts