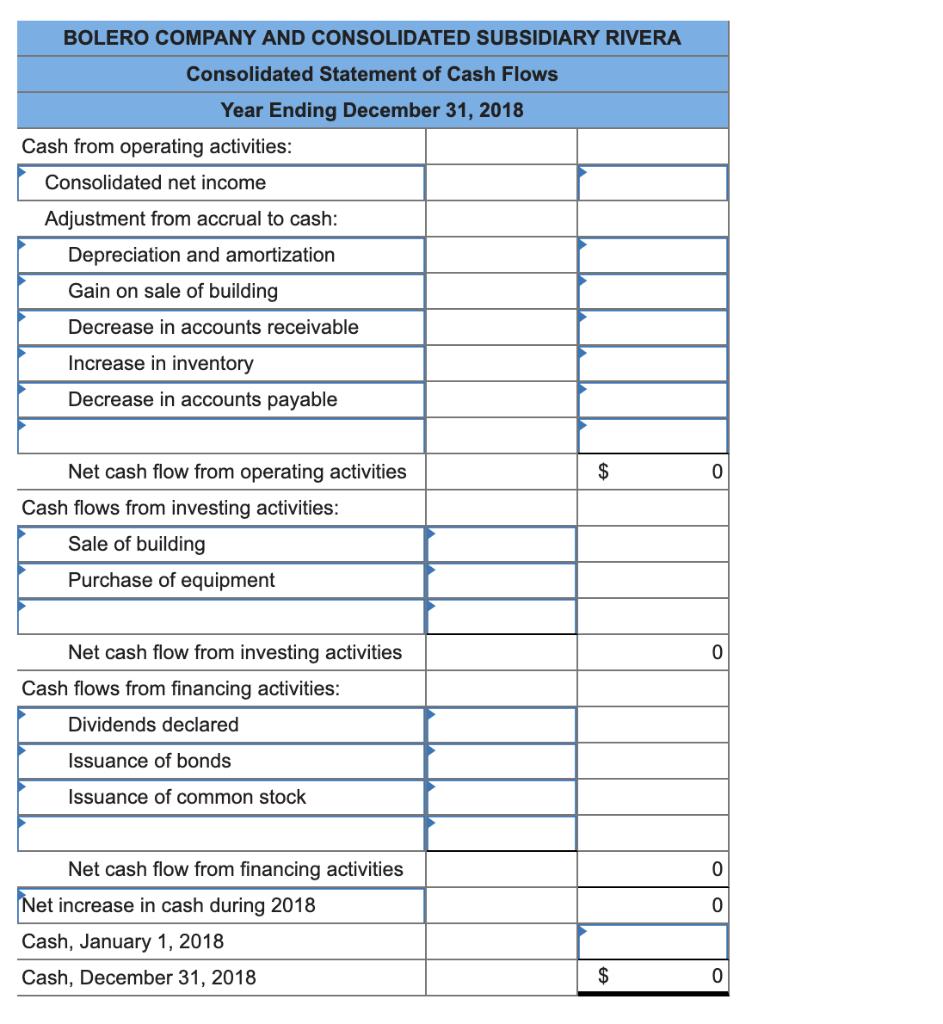

Question: Additional Information for 2018 The parent issued bonds during the year for cash. Amortization of databases amounts to $25,000 per year. The parent sold a

Additional Information for 2018

The parent issued bonds during the year for cash.

Amortization of databases amounts to $25,000 per year.

The parent sold a building with a cost of $100,000 but a $50,000 book value for cash on May 11.

The subsidiary purchased equipment on July 23 for $245,000 in cash.

Late in November, the parent issued stock for cash.

During the year, the subsidiary paid dividends of $40,000.

Both parent and subsidiary pay dividends in the same year as declared.

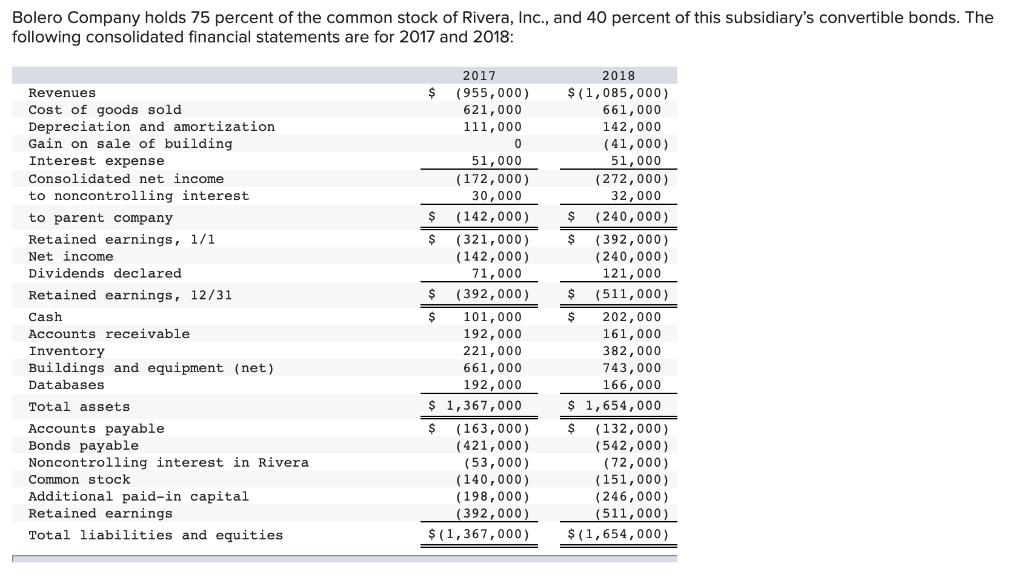

Bolero Company holds 75 percent of the common stock of Rivera, Inc., and 40 percent of this subsidiary's convertible bonds. The following consolidated financial statements are for 2017 and 2018: 2017 2018 $ (955,000) 621,000 $ (1,085,000) 661,000 Revenues Cost of goods sold Depreciation and amortization Gain on sale of building Interest expense 111,000 142,000 (41,000) 51,000 51,000 Consolidated net income (172,000) 30,000 (272,000) 32,000 to noncontrolling interest to parent company (142,000) (240,000) Retained earnings, 1/1 Net income ( 392,000) (240,000) 121,000 $ ( 321,000) (142,000) 71,000 Dividends declared Retained earnings, 12/31 $ ( 392,000) $ (511,000) Cash 101,000 192,000 202,000 Accounts receivable 161,000 382,000 Inventory Buildings and equipment (net) 221,000 661,000 743,000 Databases 192,000 166,000 $ 1,367,000 $ (163,000) Total assets $ 1,654,000 Accounts payable Bonds payable Noncontrolling interest in Rivera $4 (132,000) (542,000) (72,000) (151,000) (246,000) (511,000) $ (1,654,000) (421,000) (53,000) (140,000) (198,000) (392,000) Common stock Additional paid-in capital Retained earnings Total liabilities and equities $(1,367,000)

Step by Step Solution

3.50 Rating (153 Votes )

There are 3 Steps involved in it

A C E 1 BOLERO COMPANY AND CONSOLIDATED SUBSIDIARY RIVERA Consolidat... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

635d7af7beb43_176015.pdf

180 KBs PDF File

635d7af7beb43_176015.docx

120 KBs Word File