Question: Additional tracking data for specific identification: (1) January 15 sale200 units @ $14, (2) April 1 sale200 units @ $15, and (3) November 1 sale200

Additional tracking data for specific identification: (1) January 15 sale—200 units @ $14, (2) April 1 sale—200 units @ $15, and (3) November 1 sale—200 units @ $14 and 100 units @ $20.

(1.) What is the Cost of Good Available for Sale ? How many units are available for sale?

(2.) Using the Periodic System, determine Cost of Goods Sold (COGS) and Ending Inventory using one of the methods: Specific Identification, Weighted Average, FIFO or LIFO. Show your work.

(3.) Explain how the calculation might be different if you used Perpetual System instead.

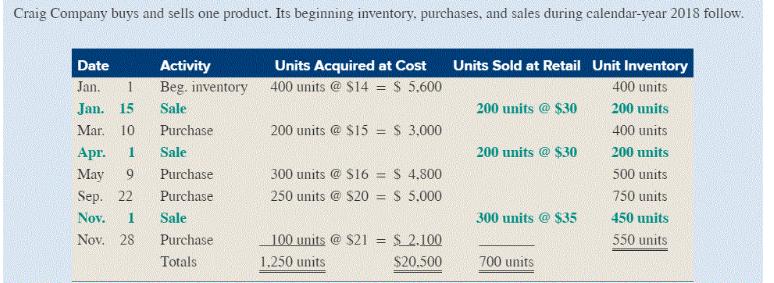

Craig Company buys and sells one product. Its beginning inventory, purchases, and sales during calendar-year 2018 follow. Date Activity Units Acquired at Cost Units Sold at Retail Unit Inventory Jan. 1 Beg. inventory 400 units @ S14 = $ 5.600 400 units Jan. 15 Sale 200 units @ $30 200 units Mar. 10 Purchase 200 units @ $15 = $ 3,000 400 units Apr. Sale 200 units @ $30 200 units May 9. Purchase 300 units @ $16 = S 4,800 500 units Sep. 22 Purchase 250 units @ S20 = $ 5.000 750 units Nov. Sale 300 units @ $35 450 units Nov. 28 Purchase 100 units @ $21 $ 2.100 550 units Totals 1,250 units $20.500 700 units

Step by Step Solution

3.36 Rating (165 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts