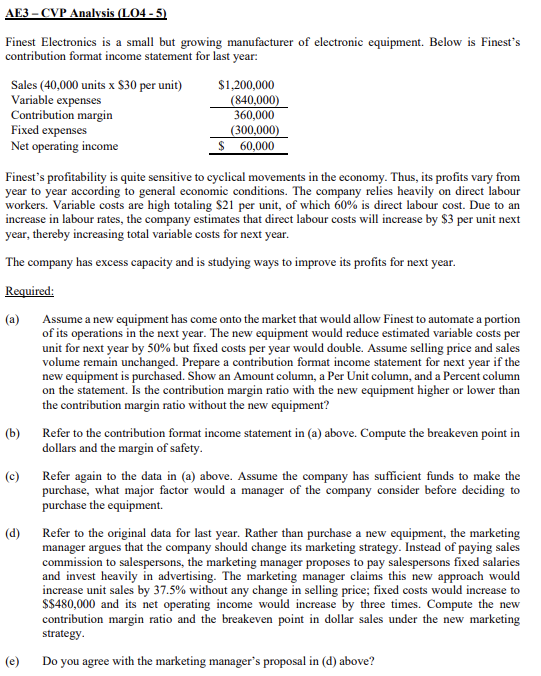

Question: AE3 - CVP Analysis (LO4 - 5) Finest Electronics is a small but growing manufacturer of electronic equipment. Below is Finest's contribution format income statement

AE3 - CVP Analysis (LO4 - 5) Finest Electronics is a small but growing manufacturer of electronic equipment. Below is Finest's contribution format income statement for last year: Finest's profitability is quite sensitive to cyclical movements in the economy. Thus, its profits vary from year to year according to general economic conditions. The company relies heavily on direct labour workers. Variable costs are high totaling $21 per unit, of which 60% is direct labour cost. Due to an increase in labour rates, the company estimates that direct labour costs will increase by $3 per unit next year, thereby increasing total variable costs for next year. The company has excess capacity and is studying ways to improve its profits for next year. Required: (a) Assume a new equipment has come onto the market that would allow Finest to automate a portion of its operations in the next year. The new equipment would reduce estimated variable costs per unit for next year by 50% but fixed costs per year would double. Assume selling price and sales volume remain unchanged. Prepare a contribution format income statement for next year if the new equipment is purchased. Show an Amount column, a Per Unit column, and a Percent column on the statement. Is the contribution margin ratio with the new equipment higher or lower than the contribution margin ratio without the new equipment? (b) Refer to the contribution format income statement in (a) above. Compute the breakeven point in dollars and the margin of safety. (c) Refer again to the data in (a) above. Assume the company has sufficient funds to make the purchase, what major factor would a manager of the company consider before deciding to purchase the equipment. (d) Refer to the original data for last year. Rather than purchase a new equipment, the marketing manager argues that the company should change its marketing strategy. Instead of paying sales commission to salespersons, the marketing manager proposes to pay salespersons fixed salaries and invest heavily in advertising. The marketing manager claims this new approach would increase unit sales by 37.5% without any change in selling price; fixed costs would increase to $480,000 and its net operating income would increase by three times. Compute the new contribution margin ratio and the breakeven point in dollar sales under the new marketing strategy. (e) Do you agree with the marketing manager's proposal in (d) above? AE3 - CVP Analysis (LO4 - 5) Finest Electronics is a small but growing manufacturer of electronic equipment. Below is Finest's contribution format income statement for last year: Finest's profitability is quite sensitive to cyclical movements in the economy. Thus, its profits vary from year to year according to general economic conditions. The company relies heavily on direct labour workers. Variable costs are high totaling $21 per unit, of which 60% is direct labour cost. Due to an increase in labour rates, the company estimates that direct labour costs will increase by $3 per unit next year, thereby increasing total variable costs for next year. The company has excess capacity and is studying ways to improve its profits for next year. Required: (a) Assume a new equipment has come onto the market that would allow Finest to automate a portion of its operations in the next year. The new equipment would reduce estimated variable costs per unit for next year by 50% but fixed costs per year would double. Assume selling price and sales volume remain unchanged. Prepare a contribution format income statement for next year if the new equipment is purchased. Show an Amount column, a Per Unit column, and a Percent column on the statement. Is the contribution margin ratio with the new equipment higher or lower than the contribution margin ratio without the new equipment? (b) Refer to the contribution format income statement in (a) above. Compute the breakeven point in dollars and the margin of safety. (c) Refer again to the data in (a) above. Assume the company has sufficient funds to make the purchase, what major factor would a manager of the company consider before deciding to purchase the equipment. (d) Refer to the original data for last year. Rather than purchase a new equipment, the marketing manager argues that the company should change its marketing strategy. Instead of paying sales commission to salespersons, the marketing manager proposes to pay salespersons fixed salaries and invest heavily in advertising. The marketing manager claims this new approach would increase unit sales by 37.5% without any change in selling price; fixed costs would increase to $480,000 and its net operating income would increase by three times. Compute the new contribution margin ratio and the breakeven point in dollar sales under the new marketing strategy. (e) Do you agree with the marketing manager's proposal in (d) above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts