Question: After you complete the Schedule C, print it, scan it, and upload it into Moodle along with a one-page Word document explaining how you

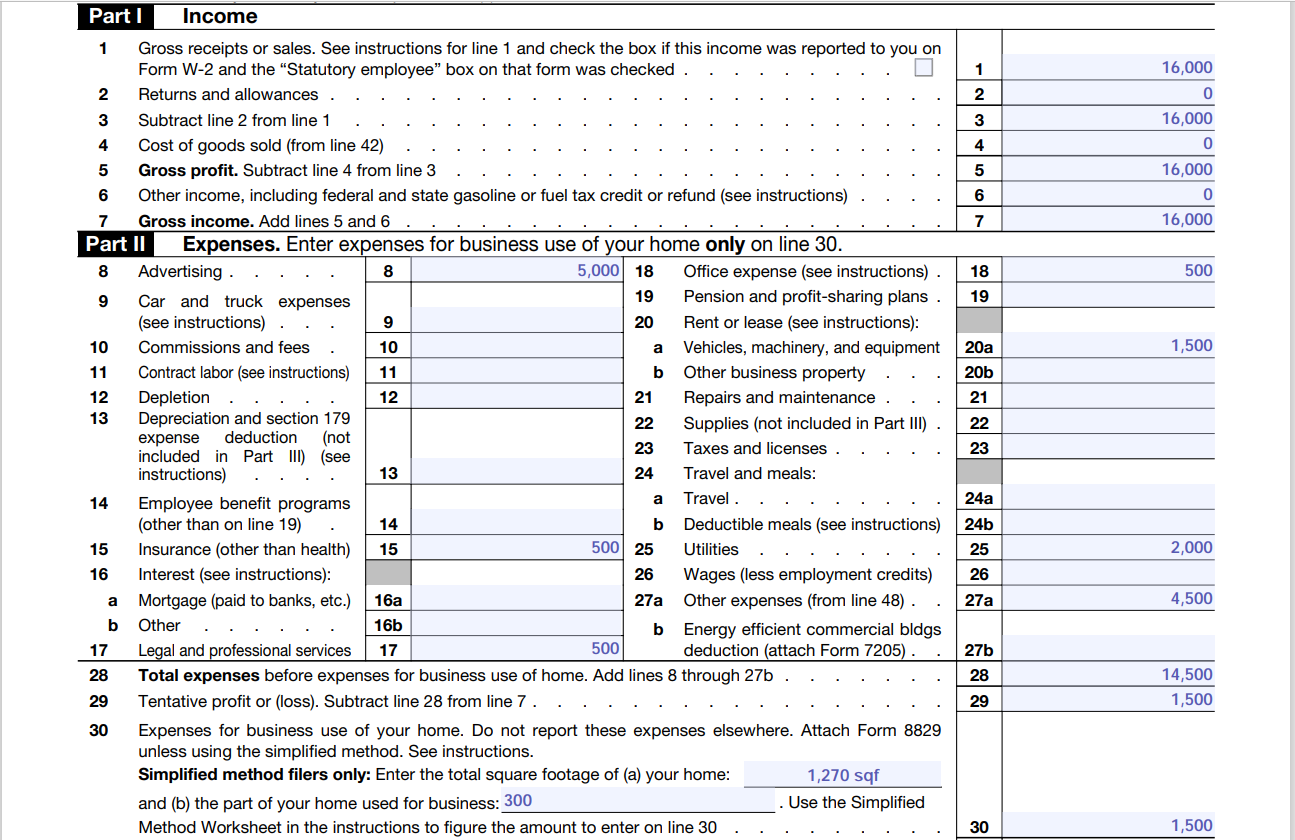

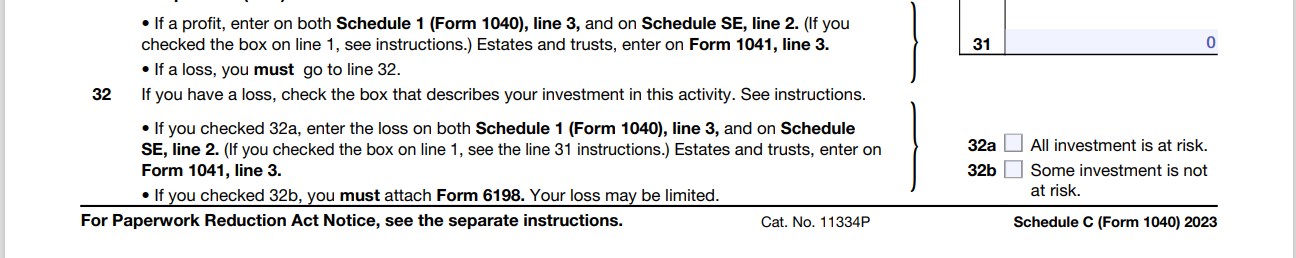

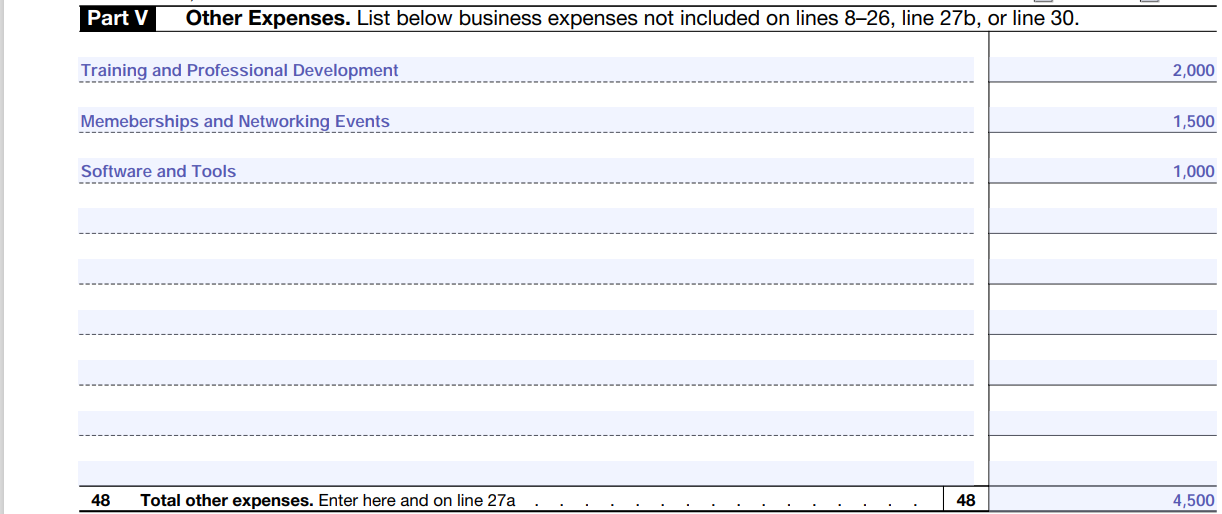

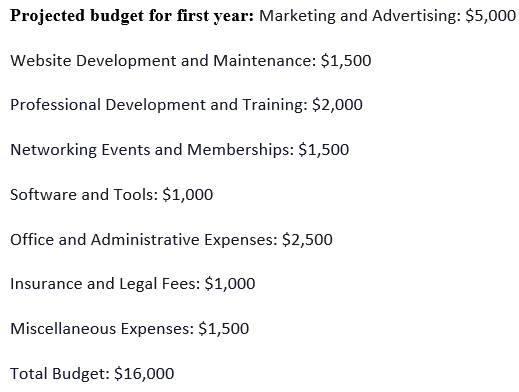

After you complete the Schedule C, print it, scan it, and upload it into Moodle along with a one-page Word document explaining how you arrived at the numbers on your Schedule C for the expense section, referencing where appropriate what you've learned about Schedule C business deductions from the Week 4 Moodle lectures and the related readings, and how those business expense deductions relate to the activity you have chosen to model. In your word document also please address "Home Office Expenses" and whether or not your chosen activity might allow for a deduction for use of a home office. Part I Income 1 Gross receipts or sales. See instructions for line 1 and check the box if this income was reported to you on Form W-2 and the "Statutory employee" box on that form was checked . . 1 16,000 2 Returns and allowances . . 2 0 3 Subtract line 2 from line 1 3 16,000 4 Cost of goods sold (from line 42) 4 0 5 Gross profit. Subtract line 4 from line 3 5 16,000 6 0 7 16,000 6 7 Other income, including federal and state gasoline or fuel tax credit or refund (see instructions) Gross income. Add lines 5 and 6 . Part II Expenses. Enter expenses for business use of your home only on line 30. 8 Advertising. 8 5,000 18 Office expense (see instructions). 18 500 9 Car and truck expenses 19 Pension and profit-sharing plans. 19 (see instructions) .. 123 10 Commissions and fees 11 12 Contract labor (see instructions) Depletion 20 Rent or lease (see instructions): 10 a Vehicles, machinery, and equipment 20a 1,500 11 b Other business property 20b 12 21 Repairs and maintenance . 21 13 Depreciation and section 179 22 Supplies (not included in Part III) 22 expense deduction (not included in Part III) (see 23 Taxes and licenses. 23 instructions) 13 24 Travel and meals: 14 Employee benefit programs a Travel .. 24a (other than on line 19). 14 b Deductible meals (see instructions) 24b 15 16 16 Insurance (other than health) 15 500 25 Utilities. 25 2,000 Interest (see instructions): 26 a Mortgage (paid to banks, etc.) 16a 27a b Other 16b b 17 Legal and professional services 17 500 Wages (less employment credits) Other expenses (from line 48) . . 27a Energy efficient commercial bldgs deduction (attach Form 7205). 26 4,500 27b 222 28 29 Total expenses before expenses for business use of home. Add lines 8 through 27b. Tentative profit or (loss). Subtract line 28 from line 7 .. 28 14,500 29 1,500 30 Expenses for business use of your home. Do not report these expenses elsewhere. Attach Form 8829 unless using the simplified method. See instructions. Simplified method filers only: Enter the total square footage of (a) your home: and (b) the part of your home used for business: 300 1,270 sqf Use the Simplified Method Worksheet in the instructions to figure the amount to enter on line 30 30 1,500 32 If a profit, enter on both Schedule 1 (Form 1040), line 3, and on Schedule SE, line 2. (If you checked the box on line 1, see instructions.) Estates and trusts, enter on Form 1041, line 3. If a loss, you must go to line 32. If you have a loss, check the box that describes your investment in this activity. See instructions. If you checked 32a, enter the loss on both Schedule 1 (Form 1040), line 3, and on Schedule SE, line 2. (If you checked the box on line 1, see the line 31 instructions.) Estates and trusts, enter on Form 1041, line 3. If you checked 32b, you must attach Form 6198. Your loss may be limited. For Paperwork Reduction Act Notice, see the separate instructions. Cat. No. 11334P 31 32a 32b All investment is at risk. Some investment is not at risk. 0 Schedule C (Form 1040) 2023 Part V Other Expenses. List below business expenses not included on lines 8-26, line 27b, or line 30. Training and Professional Development 2,000 Memeberships and Networking Events 1,500 Software and Tools 1,000 48 Total other expenses. Enter here and on line 27a 48 4,500 Projected budget for first year: Marketing and Advertising: $5,000 Website Development and Maintenance: $1,500 Professional Development and Training: $2,000 Networking Events and Memberships: $1,500 Software and Tools: $1,000 Office and Administrative Expenses: $2,500 Insurance and Legal Fees: $1,000 Miscellaneous Expenses: $1,500 Total Budget: $16,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts