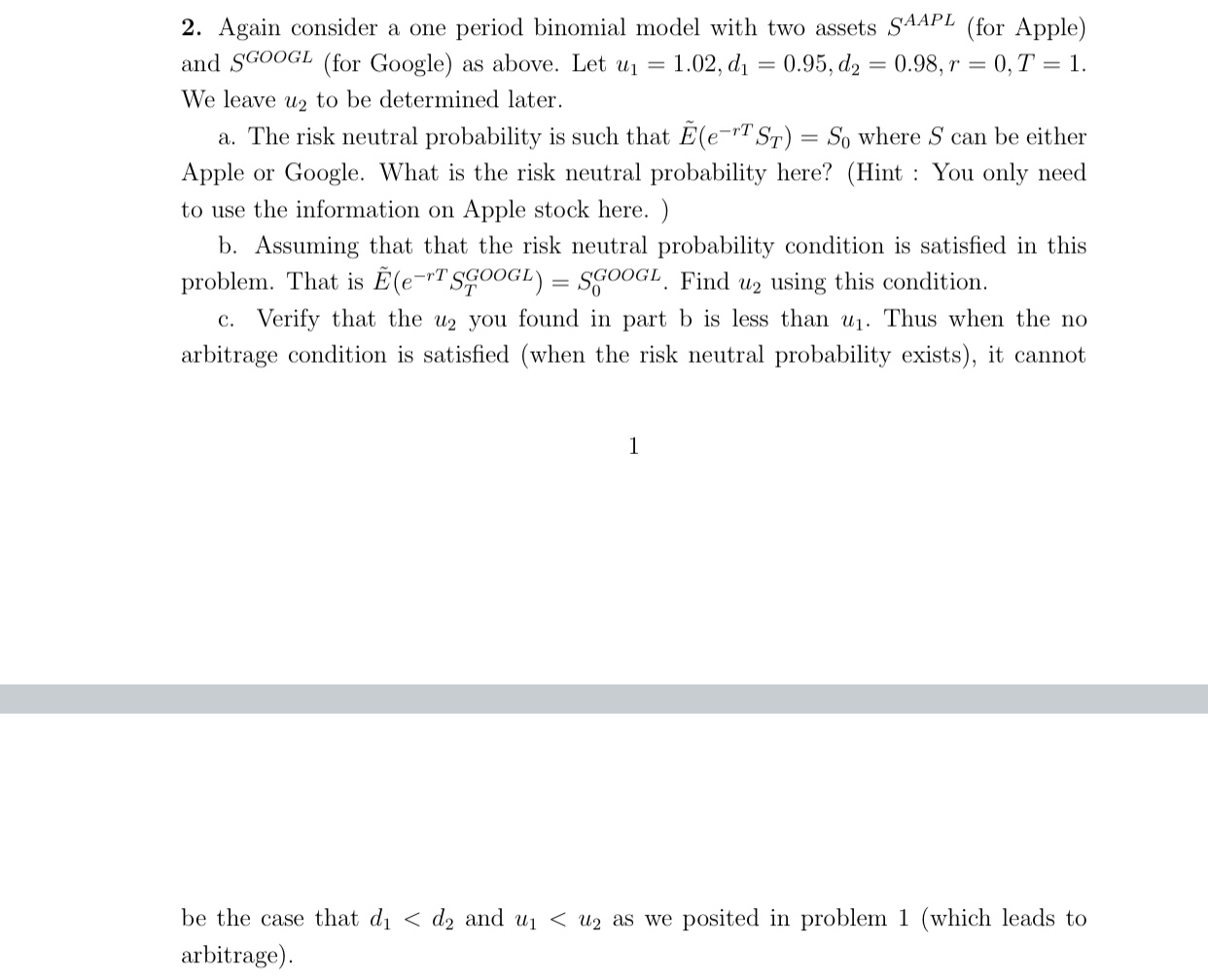

Question: Again consider a one period binomial model with two assets S A A P L ( for Apple ) and S G O O G

Again consider a one period binomial model with two assets for Apple

and for Google as above. Let

We leave to be determined later.

a The risk neutral probability is such that tilde where can be either

Apple or Google. What is the risk neutral probability here? Hint : You only need

to use the information on Apple stock here.

b Assuming that that the risk neutral probability condition is satisfied in this

problem. That is tilde Find using this condition.

c Verify that the you found in part b is less than Thus when the no

arbitrage condition is satisfied when the risk neutral probability exists it cannot

be the case that

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock