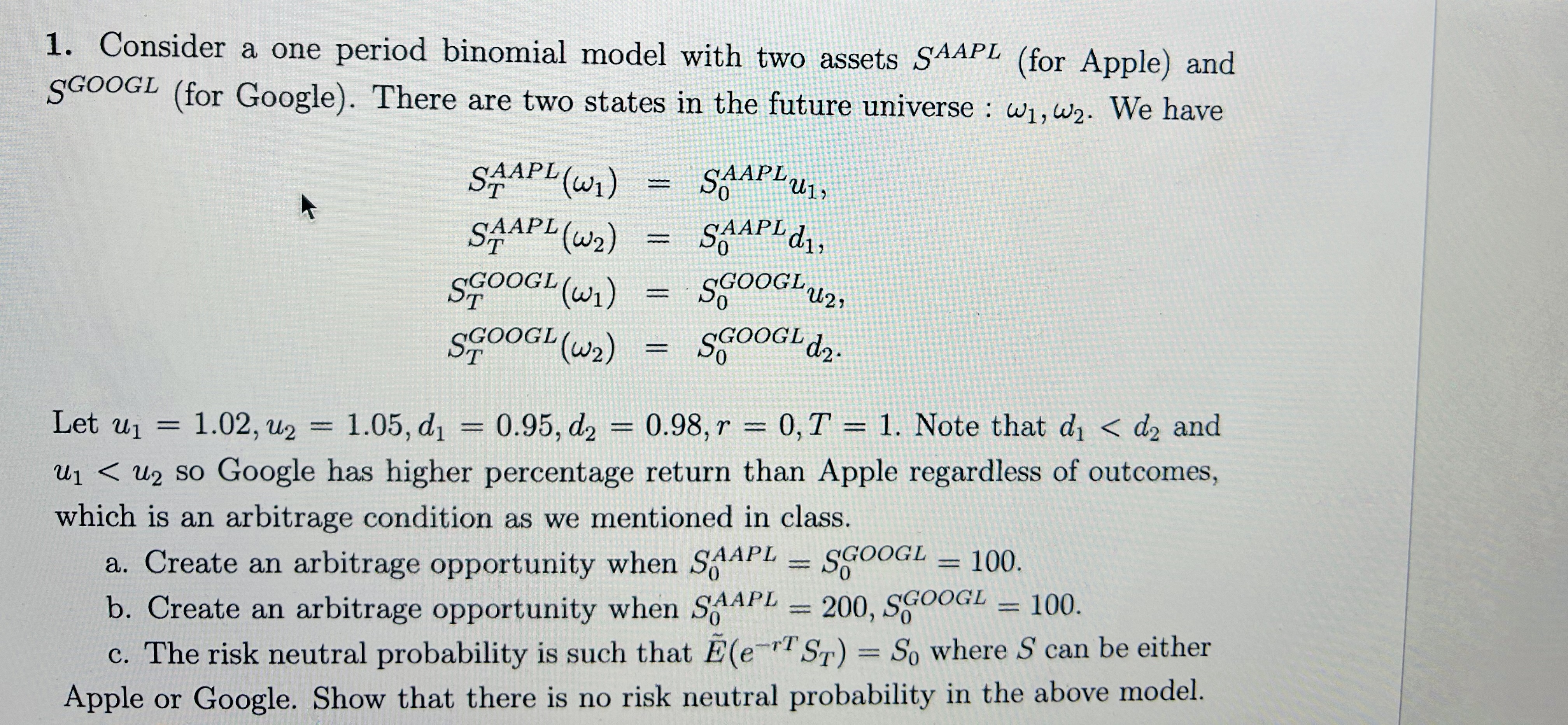

Question: Consider a one period binomial model with two assets S A A P L ( for Apple ) and S G O O G L

Consider a one period binomial model with two assets for Apple and

for Google There are two states in the future universe : We have

Let Note that tilde Google has higher percentage return than Apple regardless outcomes,

which arbitrage condition mentioned class.

Create arbitrage opportunity when

Create arbitrage opportunity when

The risk neutral probability such that tilde where can either

Apple Google. Show that there risk neutral probability the above model.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock