Question: . Albert (55 years old) is a sole proprietor. He qualified and registered as a micro business. Cash receipts for the year ended 28

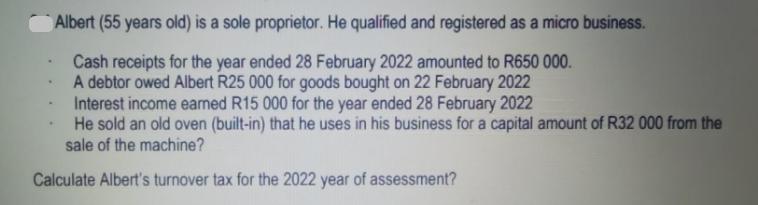

. Albert (55 years old) is a sole proprietor. He qualified and registered as a micro business. Cash receipts for the year ended 28 February 2022 amounted to R650 000. A debtor owed Albert R25 000 for goods bought on 22 February 2022 Interest income earned R15 000 for the year ended 28 February 2022 He sold an old oven (built-in) that he uses in his business for a capital amount of R32 000 from the sale of the machine? Calculate Albert's turnover tax for the 2022 year of assessment? . . Albert (55 years old) is a sole proprietor. He qualified and registered as a micro business. Cash receipts for the year ended 28 February 2022 amounted to R650 000. A debtor owed Albert R25 000 for goods bought on 22 February 2022 Interest income earned R15 000 for the year ended 28 February 2022 He sold an old oven (built-in) that he uses in his business for a capital amount of R32 000 from the sale of the machine? Calculate Albert's turnover tax for the 2022 year of assessment? .

Step by Step Solution

There are 3 Steps involved in it

To calculate Alberts turnover tax for the year of assessment we need to determine his turnover which ... View full answer

Get step-by-step solutions from verified subject matter experts