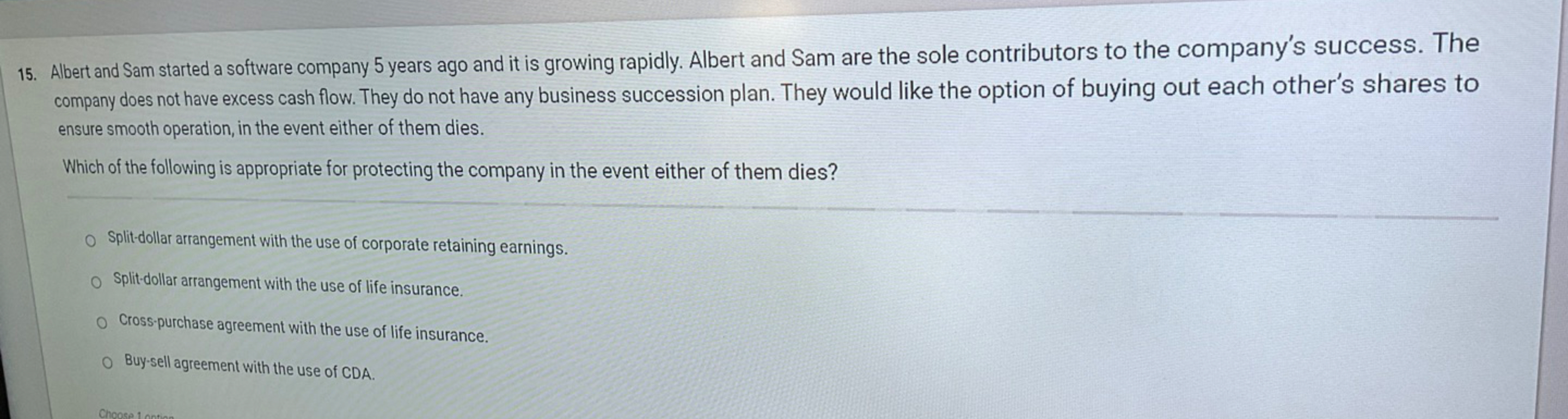

Question: Albert and Sam started a software company 5 years ago and it is growing rapidly. Albert and Sam are the sole contributors to the company's

Albert and Sam started a software company years ago and it is growing rapidly. Albert and Sam are the sole contributors to the company's success. The

company does not have excess cash flow. They do not have any business succession plan. They would like the option of buying out each other's shares to

ensure smooth operation, in the event either of them dies.

Which of the following is appropriate for protecting the company in the event either of them dies?

Splitdollar arrangement with the use of corporate retaining earnings.

Splitdollar arrangement with the use of life insurance.

Crosspurchase agreement with the use of life insurance.

Buysell agreement with the use of CDA.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock