Question: All available data to attempt to answer question below. Project cost is 184 million. Please show calculation with provided formula. Y1 184m Y2 143mY3125m Y4

All available data to attempt to answer question below. Project cost is 184 million. Please show calculation with provided formula.

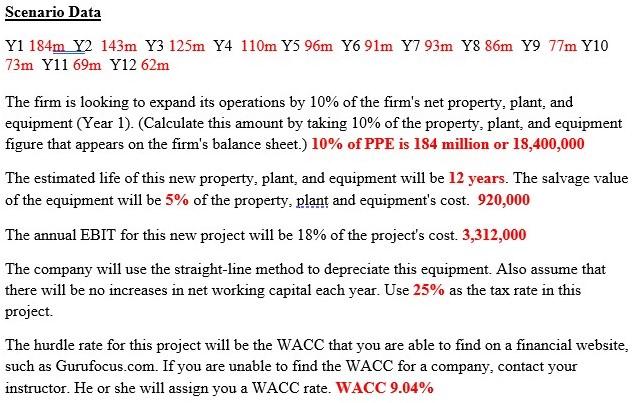

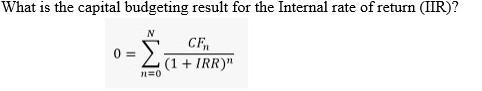

Y1 184m Y2 143mY3125m Y4 110m Y5 96m Y6 91m Y7 93m Y8 86m Y9 77mY10 The firm is looking to expand its operations by 10% of the firm's net property, plant, and equipment (Year 1). (Calculate this amount by taking 10% of the property, plant, and equipment figure that appears on the firm's balance sheet.) 10% of PPE is 184 million or 18,400,000 The estimated life of this new property, plant, and equipment will be 12 years. The salvage value of the equipment will be 5% of the property, plant and equipment's cost. 920,000 The annual EBIT for this new project will be 18% of the project's cost. 3,312,000 The company will use the straight-line method to depreciate this equipment. Also assume that there will be no increases in net working capital each year. Use 25% as the tax rate in this project. The hurdle rate for this project will be the WACC that you are able to find on a financial website, such as Gurufocus.com. If you are unable to find the WACC for a company, contact your instructor. He or she will assign you a WACC rate. WACC 9.04% 0=n=0N(1+IRR)nCFn Y1 184m Y2 143mY3125m Y4 110m Y5 96m Y6 91m Y7 93m Y8 86m Y9 77mY10 The firm is looking to expand its operations by 10% of the firm's net property, plant, and equipment (Year 1). (Calculate this amount by taking 10% of the property, plant, and equipment figure that appears on the firm's balance sheet.) 10% of PPE is 184 million or 18,400,000 The estimated life of this new property, plant, and equipment will be 12 years. The salvage value of the equipment will be 5% of the property, plant and equipment's cost. 920,000 The annual EBIT for this new project will be 18% of the project's cost. 3,312,000 The company will use the straight-line method to depreciate this equipment. Also assume that there will be no increases in net working capital each year. Use 25% as the tax rate in this project. The hurdle rate for this project will be the WACC that you are able to find on a financial website, such as Gurufocus.com. If you are unable to find the WACC for a company, contact your instructor. He or she will assign you a WACC rate. WACC 9.04% 0=n=0N(1+IRR)nCFn

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts