Question: All information to solve problem has been provided, as well as possible JE's. Please answer all parts, as they all constitute one question. Also, please

All information to solve problem has been provided, as well as possible JE's. Please answer all parts, as they all constitute one question. Also, please provide an explanation/rationale as I'm using this to prepare for an exam. Thanks.

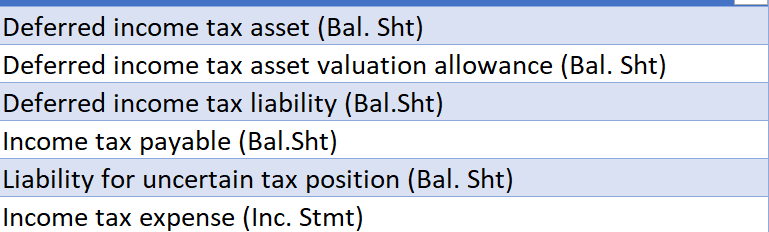

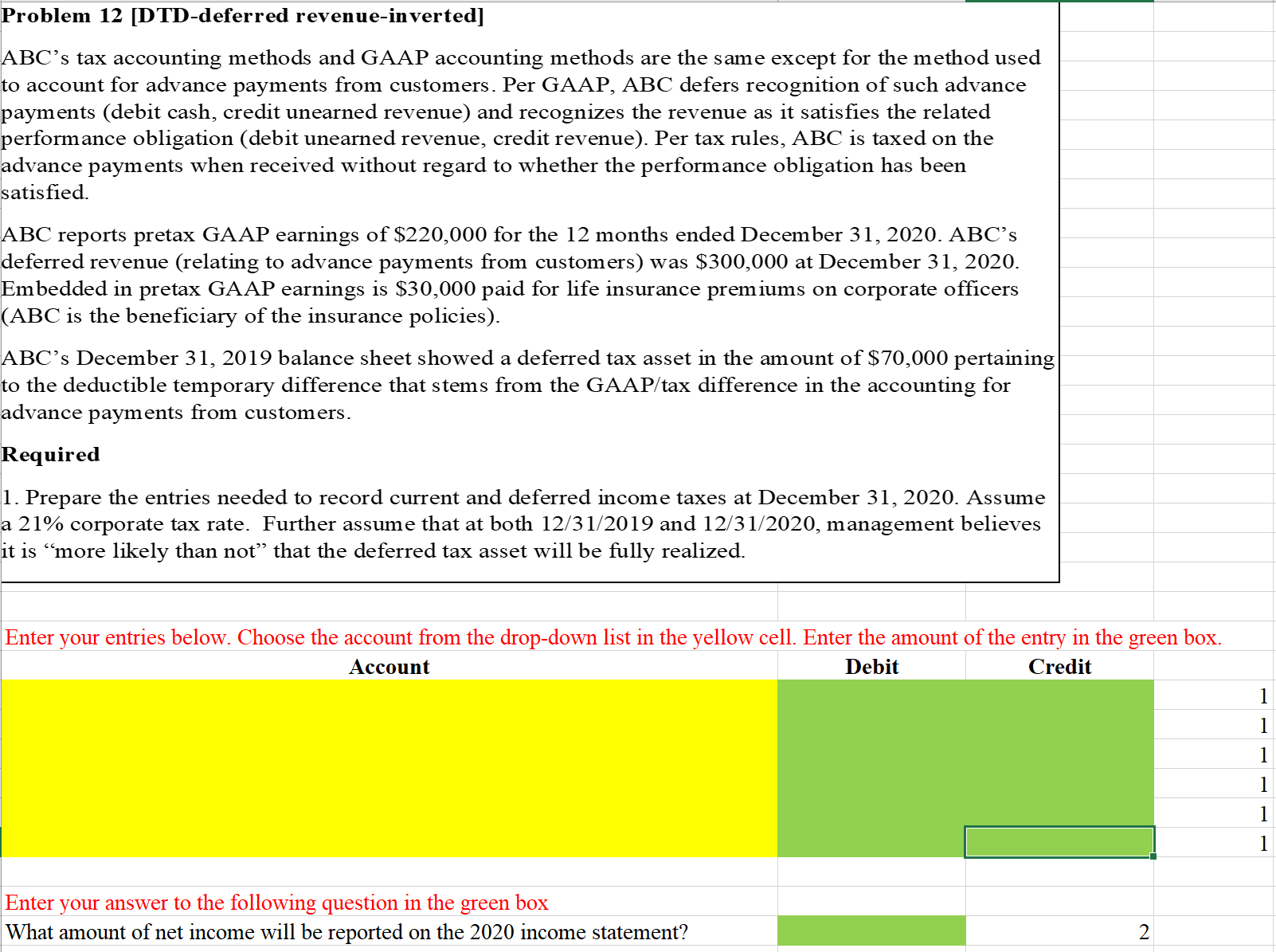

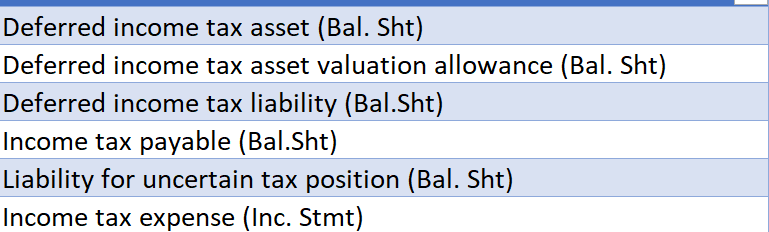

Problem 12 [DTDdeferred revenueinverted] ABC's tax accounting methods and GAAP accounting methods are the same except for the method used to account for advance payments from customers. Per GAAP, ABC defers recognition of such advance payments (debit cash, credit unearned revenue) and recognizes the revenue as it satises the related [performance obligation (debit unearned revenue, credit revenue). Per tax rules, ABC is taxed on the advance payments when received without regard to whether the performance obligation has been satised. ABC reports pretax GAAP earnings of $220,000 for the 12 months ended December 3 l, 2020. ABC's deferred revenue (relating to advance payments from customers) was $300,000 at December 31, 2020. Embedded in pretax GAAP earnings is $30,000 paid for life insurance premiums on corporate ofcers (ABC is the beneficiary ofthe insurance policies). ABC's December 3 1, 2019 balance sheet showed a deferred tax asset in the amount of $70,000 pertaining to the deductible temporary difference that stems from the GAAP/tax difference in the accounting for advance payments from customers. Required 1. Prepare the entries needed to record current and deferred income taxes at December 31, 2020. Assume a 21% corporate tax rate. Further assume that at both 12/3 1/2019 and 12/3 1/2020, management believes it is \"more likely than not\" that the deferred tax asset will be fully realized. Enter your entries below. Choose the account om the drop-down list in the yellow cell. Enter the amount of the entry in the green box. Account Debit Credit Enter your answer to the following question in the green box What amount of net income will be reported on the 2020 income statement? 2 hlhIHHHhl Deferred income tax asset (Bal. Sht) Deferred income tax asset valuation allowance (Bal. Sht) Deferred income tax liability (Bal.Sht) Income tax payable (Bal.Sht) Liability for uncertain tax position (Bal. Sht) Income tax expense (Inc. Stmt)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts