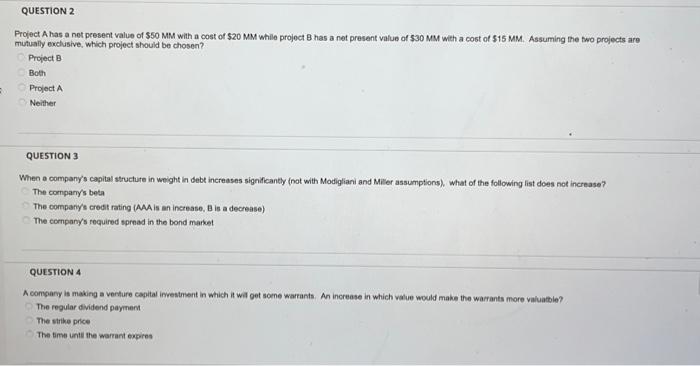

Question: all questions please ! Project A has a not present value of 550 MM with a cost of $20MM while project 8 has a net

Project A has a not present value of 550 MM with a cost of $20MM while project 8 has a net present value of $30 MM with a cost of 515MM. Assuming the two projects are mutually exclusive, which project should be chosen? Project 8 Both Project A Neither QUESTION 3 When a company's capital structure in weight in debt increases significanty (not with Modigliani and Miler assumptions), what of the following list does not increase? The compary's beta The company's creotit rating (AAA is an increase, B is a decrease) The company's required sprnad in the bond market Question 4 A comoany is making a verfure capital imrestrient in which it wat get soene wartants. An increase in which value would make the warrants more valuatble? The regular dividend payinem The strike price The time unti the warrant expires

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts