Question: allocation that represents an optimal risky portfolio on the efficient frontier, as of the end of December 2015. Given these weights, how much of the

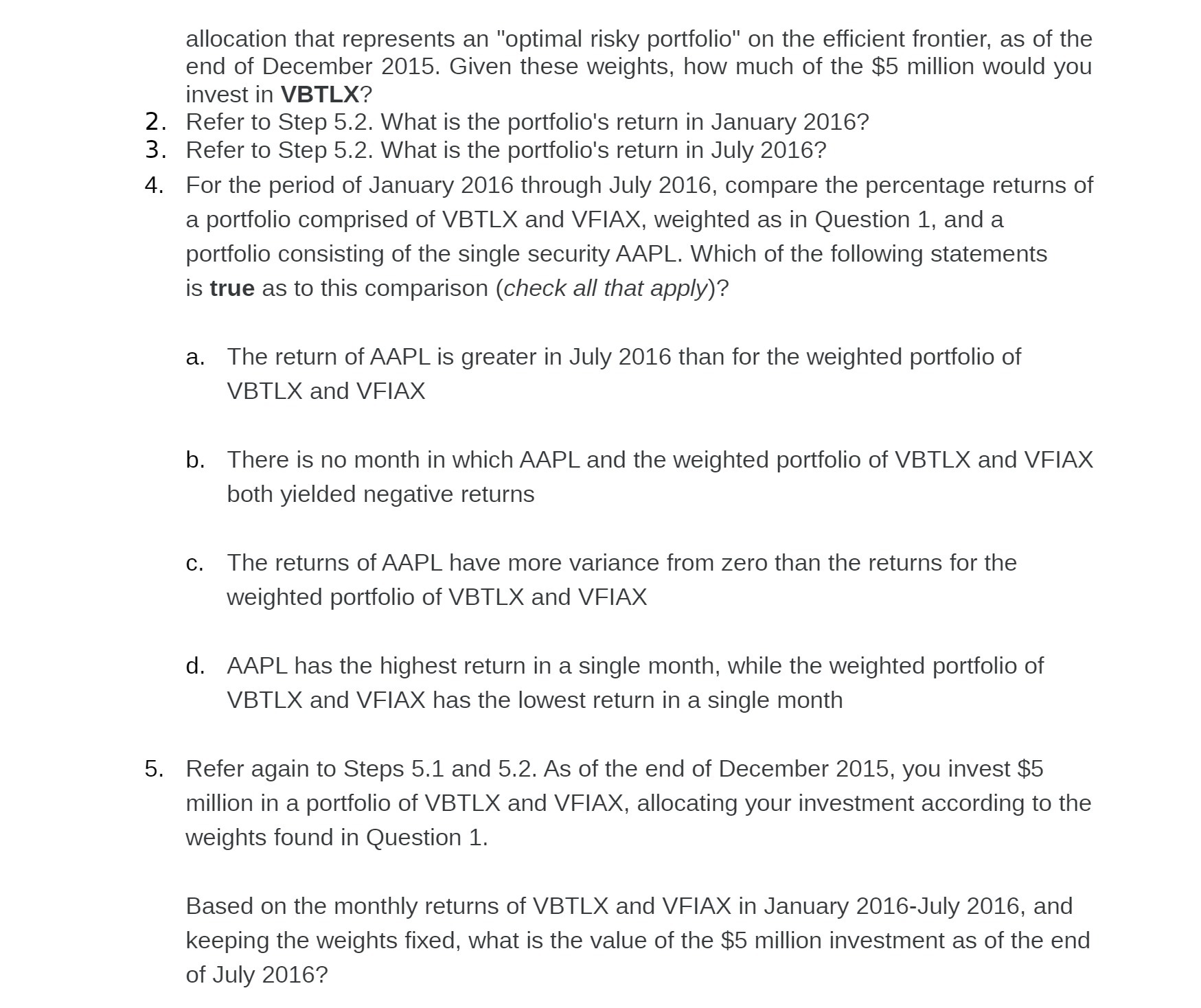

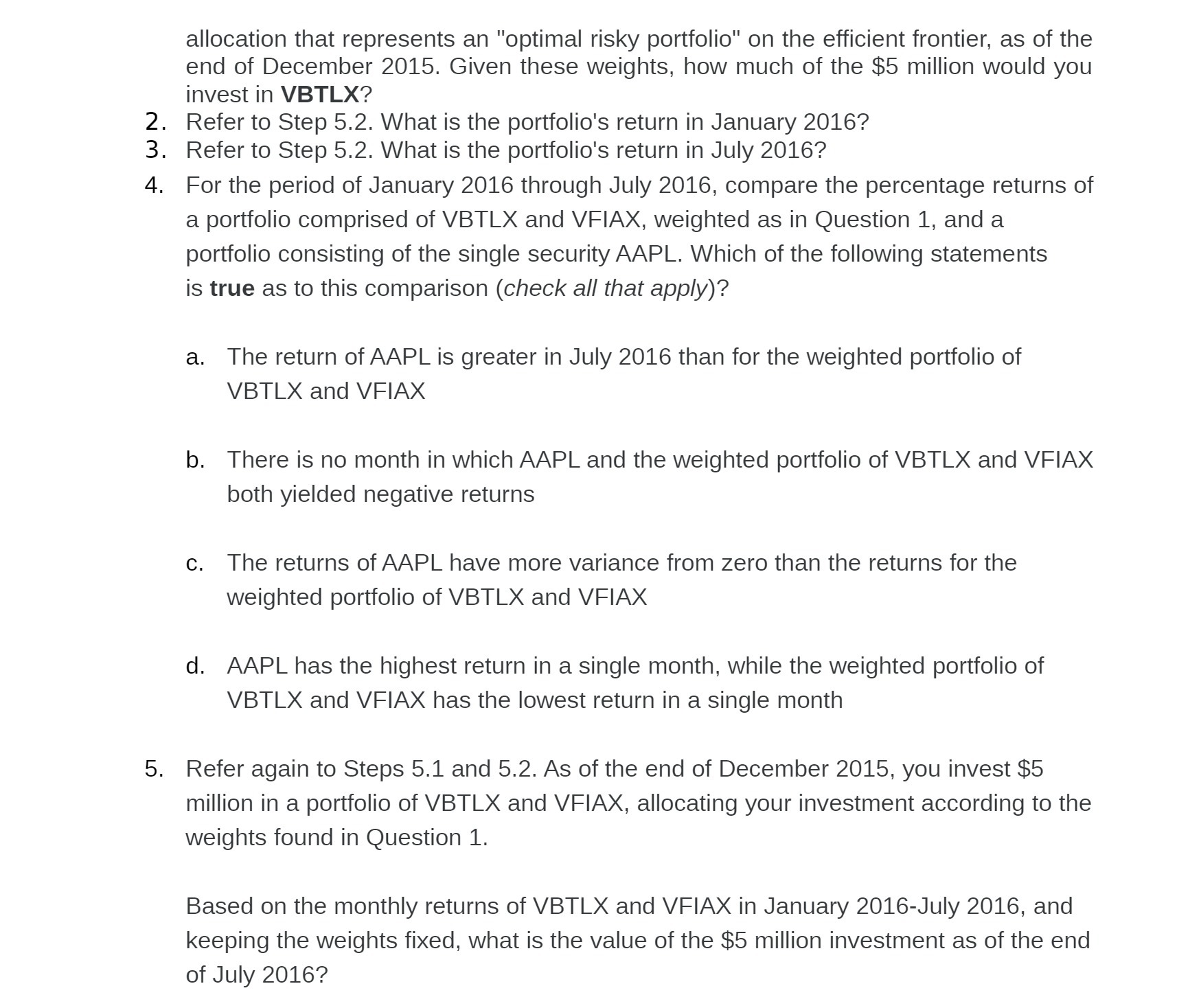

allocation that represents an "optimal risky portfolio" on the efficient frontier, as of the end of December 2015. Given these weights, how much of the $5 million would you invest in VBTLX? 2. Refer to Step 5.2. What is the portfolio's return in January 2016? 3. Refer to Step 5.2. What is the portfolio's return in July 2016? 4. For the period of January 2016 through July 2016, compare the percentage returns of a portfolio comprised of VBTLX and VFIAX, weighted as in Question 1, and a portfolio consisting of the single security AAPL. Which of the following statements is true as to this comparison (check all that apply)? a. The return of AAPL is greater in July 2016 than for the weighted portfolio of VBTLX and VFIAX b. There is no month in which AAPL and the weighted portfolio of VBTLX and VFIAX both yielded negative returns c. The returns of AAPL have more variance from zero than the returns for the weighted portfolio of VBTLX and VFIAX d. AAPL has the highest return in a single month, while the weighted portfolio of VBTLX and VFIAX has the lowest return in a single month 5. Refer again to Steps 5.1 and 5.2. As of the end of December 2015, you invest $5 million in a portfolio of VBTLX and VFIAX, allocating your investment according to the weights found in Question 1. Based on the monthly returns of VBTLX and VFIAX in January 2016-July 2016, and keeping the weights fixed, what is the value of the $5 million investment as of the end of July 2016

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts